China appears to have hit back in its tech trade war with the US by imposing new restrictions on the export of rare materials used in chipmaking. The surprise news could have serious implications for global supply chains and raise prices for IT buyers.

Last week it was revealed that the US government plans to put more controls in place to stop its companies selling to Chinese clients, which would supplement existing restrictions first introduced last October and are an effort to control China’s technological and military power. Separately Washington is said to be considering whether to introduce licensing arrangements for cloud computing services.

How China will restrict the flow of semiconductor materials

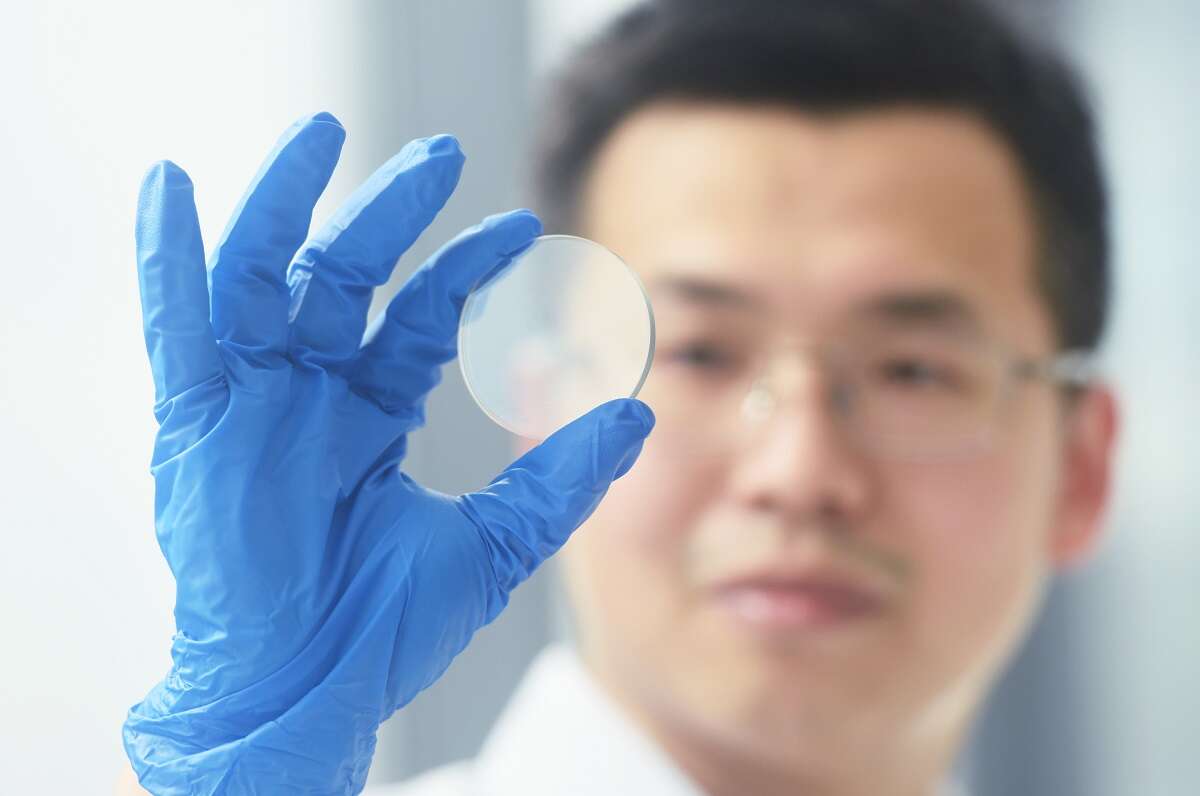

From August 1, China is applying export controls to eight gallium products and six germanium products, the country’s commerce ministry said. Exporters will need advance permission to ship the materials abroad.

Gallium is widely used in wide band-gap and compound semiconductors, for products such as power electronics and electric vehicles. Germanium, meanwhile, can be found in fibre optic communications equipment and solar panels. China is by far the world’s largest producer of Gallium, and statistics produced by the Indian government show that in 2020 it was responsible for 350 mega tonnes of the 372MT produced globally.

Permits could take as long as three months to obtain, Reuters reports today, and the news of restrictions is likely to cause price rises for buyers, and has apparently led to flurry of interest in purchasing large quantities of the materials ahead of controls being introduced.

One US semiconductor wafer manufacturer has already said it intends to obtain the permits. ATX, which makes wafers for compound semiconductors – combining silicon with materials including Gallium Nitride – says it will apply for exporting permissions through its Chinese subsidiary, Tongmei.

“We are actively pursuing the necessary permits and are working to minimize any potential disruption to our customers,” said Morris Young, ATX CEO.

Beijing’s decision to impose controls is likely to be a response to reports last week that US government is set to further tighten restrictions on the sale of AI chips by US companies such as Nvidia and AMD to Chinese clients. These restrictions will reportedly be announced later this month.

The Dutch government, working with its US counterparts, last week announced new controls on chipmaking equipment being sent to China.

It is likely to controls will also hurt other countries which buy these materials. Several UK chip companies, for example, are working on compound semiconductors, which are identified in the UK semiconductor strategy as a potential area of growth for the sector.

Will the cloud hyperscalers get dragged into the US-China trade war?

Washington is also said to be considering similar sanctions on cloud computing companies which provide services to China.

It could put export controls on hyperscale public cloud such as Amazon’s AWS, Microsoft Azure and Google Cloud, which would mean they would need to obtain licenses in order to do business with Chinese customers.

According to the Wall Street Journal, the restrictions would revolve around services which use artificial intelligence chips, of the type which are subject to export controls already.

AI has become a cornerstone of the offerings of all the major cloud providers in recent months, with Microsoft investing heavily in OpenAI, the AI lab behind ChatGPT, and infusing its cloud portfolio with automated tools. Google and Amazon have both been developing tools in-house and signing similar partnerships with other vendors.

To do this, they need large quantities of AI-specific chips. All three buy GPUs from Nvidia, while both Google Cloud and AWS have developed their own AI chips in-house.