The Dutch and US governments are imposing further controls on China’s access to equipment needed to manufacture semiconductors. The news comes days after it was reported that American companies selling AI chips to Chinese clients could be subject to new sanctions.

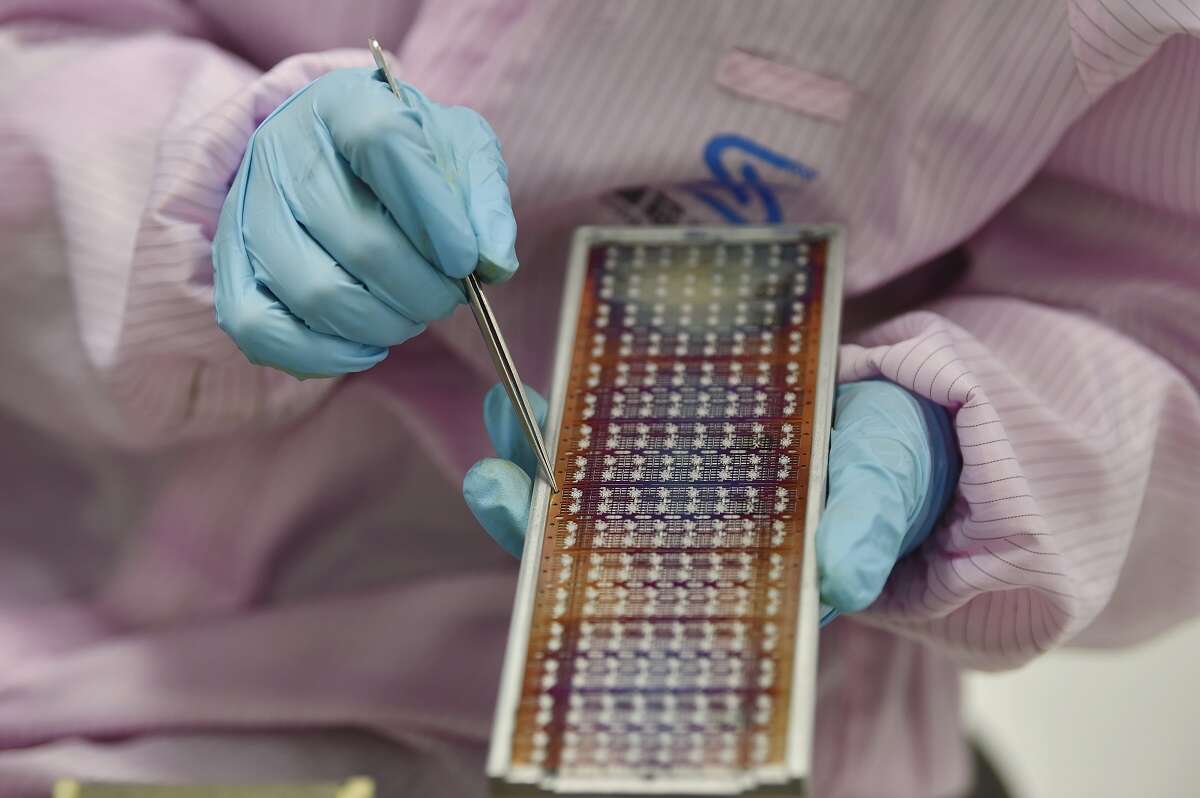

Chips have become a key battleground in the trade war between the US and China, with Washington imposing increasingly stringent export controls on businesses which make and sell components in the Far East, in a bid to control China’s technological and military capabilities.

ASML in the firing line as US plans fresh China semiconductor controls

This morning the Dutch government said new controls on ASML, the Netherlands-based company that is the world’s only supplier of advanced lithography equipment used in making leading edge chips, and other companies in the chip supply chain, will come into force on September 1.

ASML is already banned from selling its most advanced technology, EUV lithography machines, to Chinese clients, and the new controls will mean its second most powerful line, DUV machines, will now only be able to be sold in China with a special license.

Trade minister Liesje Schreinemacher said the equipment may have military applications. “We have taken this step in the interest of our national security.” he said.

The US government, meanwhile, is set to publish a list of six semiconductor factories, or fabs, where licenses will be required if ASML wants to deploy DUV equipment. This list is likely to include a fab run by SMIC, China’s biggest chipmaker, and Reuters, which first reported the news, says any requests to license equipment to these factories will likely be denied on security grounds.

Last October, Joe Biden’s government imposed strict controls on US businesses involved in other parts of the chip supply chain, such as Lam Instruments and Applied Materials, while Japan has also joined the blockade of China by applying similar rules to companies like Nikon and Tokyo Electron, which make chip manufacturing machines.

In response, China has sanctioned US memory chip maker Micron Technology, banning it from all Chinese national infrastructure on security grounds.

Could the US impose more controls on selling AI chips to China?

ASML is not the only semiconductor business set to count the cost of the US China trade war. This week it was reported that more rules could be drafted to restrict the sale of chips needed to run artificial intelligence systems in China.

Companies such as Nvidia and AMD were banned from selling advanced GPUs to Chinese clients under the export controls introduced in October. Nvidia sought to get round this by developing its A800 chip, a pared back version of its flagship A100 GPU specifically designed for the Chinese market and that was compliant with the rules.

However, according to the Wall Street Journal, the US government is considering whether to force Nvidia to obtain a license if it wants to continue to sell the A800. It is also mulling more controls on cloud AI systems, which are apparently being used by vendors to get around the ban.

While such rules make sense on a geopolitical level, they could prove harmful to US businesses like Nvidia. Speaking at a conference on Wednesday, the company’s CFO Colette Kress said that while the rules may not cause any disruption in the next few months, they are likely to hamper Nvidia’s earning power in the long term.

“Restrictions prohibiting the sale of our data centre GPUs to China, if implemented, would result in a permanent loss of opportunities for US industry to compete and lead in one of the world’s largest markets and impact on our future business and financial results,” Kress said.