Silicon’s status as the material underpinning the semiconductor industry has been unchallenged for decades. But as businesses continue to demand more powerful and energy-efficient devices and digital systems, other options are entering the fray. Chips based on gallium nitride, or GaN, are becoming increasingly popular among manufacturers, particularly those developing semiconductors for power electronics, and could be ready to make a sustained challenge for silicon’s crown.

GaN’s passage from the lab to the real world has accelerated in recent years, and last month STMicroelectronics, one of Europe’s biggest chipmakers, launched a new set of GaN semiconductors designed for electric vehicles. ST’s interest in GaN is well established, and earlier this year the company brought a majority stake in Exagan, a French developer of GaN products. Describing the material as “very promising”, Jean-Marc Chery, president and CEO of STMicroelectronics, said: “The acquisition of a majority stake in Exagan is another step forward in strengthening our global technology leadership in power semiconductors and our long-term GaN roadmap, ecosystem and business.”

The world’s largest chip foundry, TSMC, is also getting in on the act, and earlier this year reportedly invested in 16 specialist pieces of machinery to cater for increasing demand for GaN chips. Given the material’s enticing properties, it is no surprise that some of the industry’s biggest names have started to take an interest.

GaN vs silicon: what is gallium nitride?

Gallium Nitride itself is not a new material. “It’s widely deployed in LED lighting,” explains Professor Rachel Oliver, director for the Cambridge Centre for Gallium Nitride at the University of Cambridge. “The 2014 Nobel Prize for Physics was awarded to the inventors of the blue LED, which has been fantastically successful and is a GaN product.” Indeed, blue LEDs have been around since the 1990s, and commercially available as part of display screen and other products for 15 years.

What sets GaN apart from silicon is its wider “band gap”, which defines how well a material conducts electricity. Broadly speaking, wider band gap materials are able to cope with more energy. “You can go to high voltages and handle higher amounts of power,” explains Oliver. “So with GaN you’ve got a material that can deal with very high power and deal with it efficiently because there’s relatively little resistance compared to silicon. This means less energy is wasted, and you can also achieve very high switching speeds, which is important for use cases like communications.”

The business case for GaN: into the data centre?

While pure GaN semiconductors deliver the biggest performance advantages over silicon, marrying the two materials together has been driving new use cases. “The innovation happening here is placing gallium nitride on top of silicon, which helps to reduce the costs, and in some places, get some synergies from the silicon supply chain,” says George Brocklehurst, VP manager in the tech CEO research practice at Gartner, who covers innovations in semiconductors. “What this has done has enabled the use of this material at a much lower cost. You trade off some of the performance, but you get something that is significantly better than silicon.”

The dominant use case for GaN-based chips is in power management chips, which manage the conversion and distribution of electricity in devices such as phone and laptop chargers. “There’s already a lot of take-up going on industrially around power, and you can buy very small chargers for mobile phones which are GaN-based,” says Professor Oliver. “When you hold a [silicon-based] laptop charger for example, it usually gets very hot, which means a lot of energy is being wasted in the power transition. If you do the same thing with gallium nitride, it wastes much less energy. There are a lot of situations where we need to handle power where GaN may be the next big material.”

Indeed, with total electricity production rising rapidly, using it more efficiently has become a key driver for businesses trying to move towards net zero, not least those who operate and use the data centres that are central to cloud computing.

Brocklehurst expects GaN to move into data centres sooner rather than later. "The trends driving demand are the need for more power in less space," he says. "Companies want more power density, and the power supplies that go into servers could definitely benefit from these kinds of efficiencies, particularly as we see increased use of things like mass AI processing in data centres." The saving on things like cooling systems could also enable more powerful data centres to be built, Brocklehurst adds. "You're pushing less heat into the data centre, and electronics typically don't perform efficiently at higher temperatures," he explains. "And you're doing everything in less space, so you can push more processing per square foot."

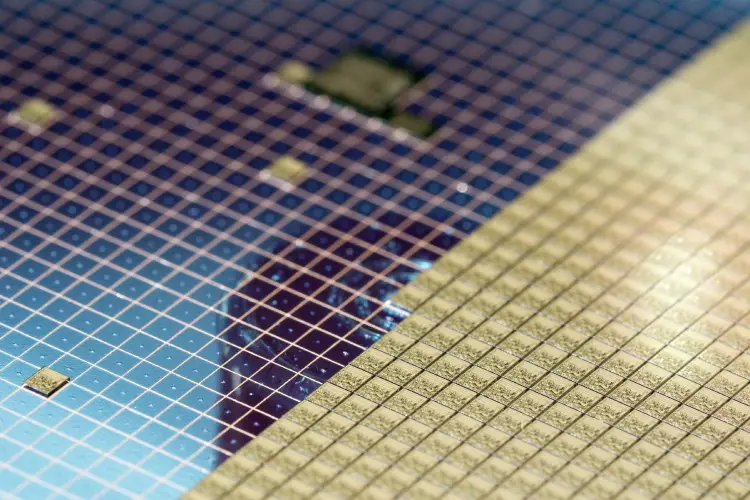

Indeed, size could also play in GaN's favour, particularly in light of the global chip shortage which is set to affect a wide range of business sectors for at least another year. Though the current situation was driven by the Covid-19 pandemic, structural issues in the silicon supply chain mean future shortages are likely. Navitas is a company which makes GaN chips for use in power electronics. The company, which is planning to IPO later this year, works with TSMC to produce its products, utilising one of the Taiwanese company's old production lines. "We're using silicon equipment that's been written down in financial terms," says Stephen Oliver from Navitas. "With TSMC, we're using their oldest foundry still running, and because our chips are five times smaller than the silicon equivalent, you can get a lot more on a wafer. So while the world is going crazy and you're seeing lead times on silicon of up to 52 weeks, we're on 12 weeks with capacity to spare."

The future of GaN: logic chips and more

With the power chip makers firmly switched on to the benefits of GaN, attention is starting to turn to other areas, including processors. "If you'd asked me ten years ago whether we could do logic with gallium nitride, I'd have said don't be silly," says Professor Oliver. "But we're seeing steps towards it, partly because these GaN power devices need to be controlled by automated systems that are currently made of silicon, and in some cases, this is limiting their performance."

While this work on GaN logic chips remains at the research stage, the big companies in the semiconductor industry have started to take an interest, and Professor Oliver says her lab has been in discussions with one of the biggest Silicon Valley chipmakers about the potential of GaN chips. "There's an awareness that in the end the performance limits of silicon will be reached," she says. "They've already taken it an incredible amount further than we ever thought they would, but there's a recognition that we'll need a change."

Gartner's Brocklehurst agrees: "You can continue to tweak silicon but it will never give you the step-change GaN potentially offers," he says, adding that while there are no known major safety or reliability issues associated with GaN, cost and volume remains a barrier to adoption. "Some of the very high-value cases around power and energy are in automotive and manufacturing, two markets that are characterised by their risk aversion," he explains. "It's going to take time to socialise this technology, build it into leading adoption, and build on volume to drive down the cost."

With this in mind, TSMC's interest in the technology could be critical, Brocklehurst argues. "TSMC has a track record for helping its clients develop their technologies, so this lowers the barriers from just vendors who can afford their own foundries to those who work fabless," he adds. "That's another interesting flag of GaN's potential."