“We’re in a competition with China and other countries to win the 21st century,” Joe Biden remarked in his opening presidential speech to Congress in April 2021. It’s a competition the US president is determined to win, and his trade policy programme since arriving in the White House has seen China’s access to key technologies heavily restricted to help the US retain its competitive advantage.

One of these technologies is semiconductors, with export controls put in place to stop Chinese companies buying advanced chips made in the US, as well as the kinds of equipment Chinese foundries need to design their own. A fresh tranche of restrictions, unveiled earlier this month, restrict US businesses from selling Chinese customers the machines used in the production of sub-14 nanometer semiconductors, the same used to make the world’s most advanced chips. Additionally, any business with operations in the US is now banned from exporting any chipmaking equipment to Chinese customers that cannot be provided by foreign competitors.

The ban is already having an impact. Dutch company ASML, the world’s only producer of the lithography machines that are vital in the semiconductor production process, has reportedly instructed US-based staff to have no contact with Chinese customers (ASML was already banned by the US from selling its most advanced EUV machines to China). ASML said it expects the impact of the sanctions to be “limited” as part of the announcement of its third-quarter results.

Other key companies in the chip supply chain, such as Lam Research, Applied Materials and KLA Corporation, are also taking steps to comply with the rules, while US vendors AMD and Nvidia had previously been instructed not to sell AI chips to China or face government action. Elsewhere, US tech companies including Dell and HPE, which offer servers with advanced chips in them to Chinese clients, could be impacted.

While these measures make sense for the US on a geopolitical level, further restrictions are likely to hit businesses in the pocket.

China has semiconductor strengths

The size of the Chinese market means it is a vital one for many chipmakers. Research from GlobalData shows that China consumes around 40% of semiconductors manufactured globally, but is only 12% self-sufficient. The market is expected to grow to more than $1trn by 2030, according to analysis from industry group SEMI, with China accounting for 90% of the growth over the next eight years.

Foreign companies have been cashing in. China is by far the biggest market for South Korea’s Samsung Electronics and memory chip maker SK Hynix, while ASML currently derives 20% of its revenues from China, and power semiconductor specialists STMicroelectronics, Infineon and NXP are also heavily reliant on Chinese clients.

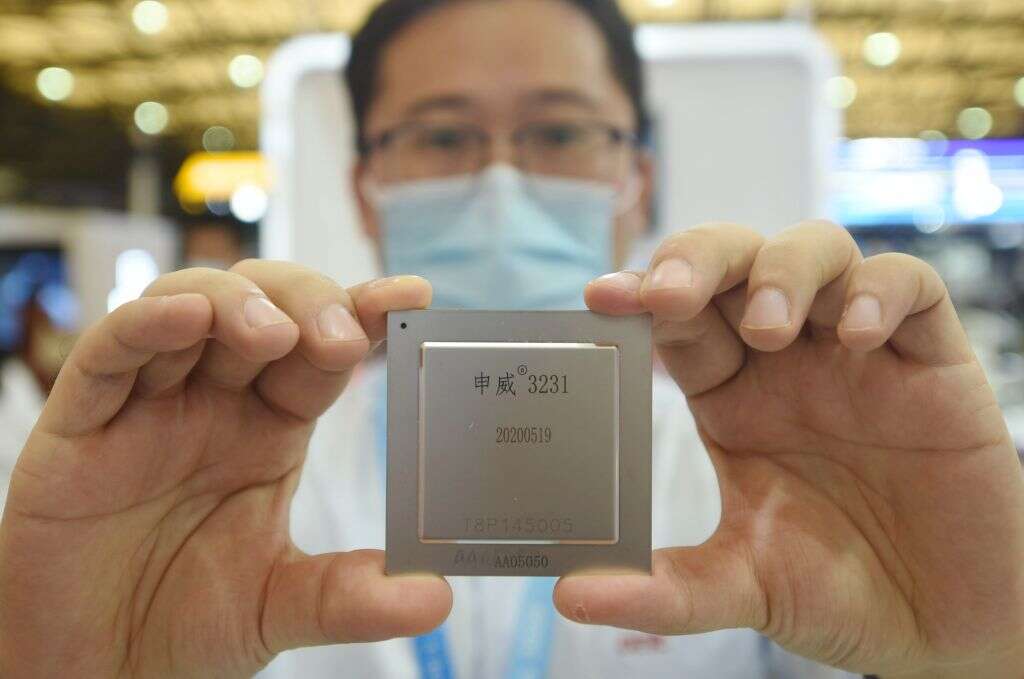

China has been investing heavily in its own capabilities. SMIC, China’s biggest chip manufacturer, has been building foundry capacity and appeared to make a breakthrough earlier this year when it was reported to have developed its first chips built on the 7nm process nodes, one of the more advanced chipmaking technologies. This is still someway behind Samsung and Taiwan’s TSMC, the chip market leader, both of which are working on 3nm technology. Nevertheless, the supposed breakthrough came as a surprise to many.

Memory manufacturer YTMC has also been growing its business, but both companies are feeling the impact of the US export controls. YTMC has seen a deal to supply memory to Apple cancelled in the wake of the new rules, while Bloomberg analysts wrote last week that they expect SMIC’s revenue growth to be 50% lower than previously planned as a result of the sanctions.

Though significant at home, SMIC remains a relatively minor player in the global chip manufacturing space, which is dominated by TSMC.

Will the export controls on China work?

The impact of the restrictions introduced this month should not be underestimated. "The new US export controls that target China's access to advanced chips and semiconductor manufacturing equipment may be crippling for China's semiconductor industry", says John Lee, director of the East-West Futures consultancy and an expert on the Chinese digital economy. “The controls are potentially so wide ranging and deleterious that the future course of Chinese industrial development, including that of multiple end user industries that rely on semiconductors, is now in question."

It is likely they will help the US maintain some advantage when it comes to artificial intelligence systems argues Mike Orme, who covers the semiconductor market for GlobalData.

"Washington reckons that the weaponisation of US semiconductor tech intellectual property is the best chance of stopping China replacing it as the global superpower by 2035 or so," Orme says. "The bans on Nvidia and AMD selling their most advanced AI chips to Chinese research institutes and companies such as Huawei, Alibaba, Horizon Robotics and Baidu will hold back China's ability to train large AI models and build inference platforms as China has no domestic capability to make such powerful chips."

China is "already at parity with the US and many areas of AI", Orme says, and "in supremacy in AI lies scope for world domination".

But most of the chips consumed in the Chinese market are not leading-edge designs for new smartphones and data centres. The biggest demand is for more rudimentary semiconductors used in IoT-connected devices and other electronics, which can be manufactured on older process nodes.

In this respect China is well placed to become more self-sufficient, Orme says, adding that SMIC's investment in these older processes could serve it well as it looks to win business in other parts of the world.

"I can well see SMIC becoming a global foundry of note by end of 2023 for 14nm and low process node chips given that China is good at packaging and test and assembly," he says. "It is building extra capacity like crazy, notably in 22nm tech."

Lee agrees that Chinese chip companies can continue to thrive despite the sanctions. "The concentration of globalised manufacturing in China and the size of China's domestic markets means that Chinese firms can do very well operating at home," he says. "It's important to remember that many foreign industry leaders, in the semiconductor sector and other manufacturing verticals, are still doing business in China. So, even operating within China, Chinese companies are still participating in the international economy."

US chipmakers could be collateral damage

While the new rules serve the US government's political objectives, executives at its top chipmakers could be left counting the cost at a time when they are already facing up to an economic slowdown and the end of the global chip shortage.

While the government may point to the CHIPS and Science act, which pledges to invest up to $52bn in the nation's semiconductor sector to support manufacturing and R&D, the new restrictions on working with Chinese customers will hit profit margins at some of the biggest US semiconductor companies.

"Nvidia and AMD can still sell older and less powerful AI chips to Chinam and Nvidia has a significant R&D operation in China where it gets around a quarter of its overall revenue," Orme says. "The ban will leave a $400m hole in that revenue."

Moreover, he says, the make-up of the semiconductor market means ongoing action against Beijing will affect other companies, too. "The semiconductor industry relies on both US IP and the Chinese chip market, and the US chip industry derives over 30% of its revenues from its China sales," Orme says. "A further blockading of China would threaten the future of the US chip companies. This is the serious conundrum facing the industry - in hurting China to protect its sovereignty, the US will hurt its most important strategic industry."