There is no doubt that the hype around digital transformation and jobs replacement continues to gather steam. Finance and accounting (F&A) is one of the professions which consistently tops the lists of jobs that robotic automation and artificial intelligence (AI) can impact substantially.

Based on our experience transforming F&A operations for large corporations, Genpact believes that within the next three years, most F&A organisations will have significant digital process automation and a hybrid workforce of humans and process robots.

So what does this mean to F&A organisations and finance leaders? We see four core tenets that drive success in digital transformation and the effective use of hybrid labour.

Removing the robotics processes from human jobs

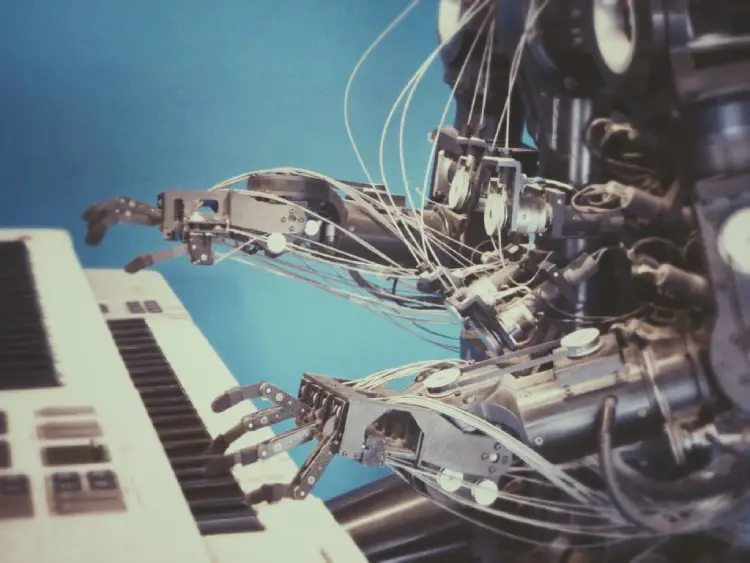

Process automation is not about replacing humans with robots but more about removing robotic processes from human jobs. This is not just a play of words. Process automation’s early initiatives tried to automate individual jobs, which was one of the biggest reasons for failures and frustration. Since results included only small portions of tasks automated, enterprises were not able to achieve the true release of labour and generate the expected return on investment (ROI).

This has two clear implications – the first is process robotics needs process reengineering. Historically, companies manage most processes by an organisation structure as opposed to crafting processes to optimise flow of information and work. To achieve success, enterprises must re-imagine and re-engineer the entire process flow. Streamlining processes is critical even when automating small, micro tasks to ensure that automation itself doesn’t create extra work. For example, if a robot can’t manage some parts of a process, and that causes exceptions that require manual intervention, this handoff impacts the cycle time for the process automation, and destroys the ROI.

The second implication is that process automation ROI is directly proportional to scale of processes. This is an accelerating curve, and it is intuitive. Let’s remember why we believe process robots produce attractive ROI and productivity – essentially, they can do the same work faster, more accurately, and around the clock. We can assume these results impact the scale of processing

Robotics is only one piece of the puzzle

Robotics is only one part of the process automation and transformation jigsaw puzzle. True process automation combines several digital disruptions from dynamic workflows to computational linguistics and natural language processing to advanced analytics to machine learning to conversational AI (chatbots). As many companies jumped onto the robotics bandwagon, it became evident that process automation’s real power is the cocktail, and like a good cocktail, every situation requires a mix of different ingredients. The fundamental implication is that labour substitution is only the beginning. Digital transformation’s core results are speed (via dramatically reduced cycle time), agility, customer experience enhancement, and therefore the ability to differentiate, both with internal processes and external customer-facing processes.

It’s all about the journey

Digital transformation is a journey and not an event. Business processes are continually evolving. With customer-centric design philosophy and an increasingly demanding marketplace, processes will evolve and change much faster. As an enterprise automates parts of a process, it often will have to make changes to that automation.

In addition, the definition of what enterprises can automate and augment changes every day as AI technologies mature rapidly. Journeys need frameworks for coping with such change in technology and choice of partners, as well as centralised governance and monitoring system. This is often overlooked, and is differentiating progressive businesses from those that do not realise benefits fully across their enterprises.

Humans need to upskill

The fourth and final tenet is the understanding that human labour will not just do the parts left after digital transformation – it will do that and many different things, and need very different skillsets. Think of how analysis changed with spreadsheets. It did not just do what people were doing on their calculators before – it created opportunities for finance and other workers to explore, model, and analyse in many different cuts, many times leading to “paralysis by analysis.”

Digital transformation will create three downstream impacts: First, it will allow for rapid experimentation with process changes. One of the key issues for finance was rigidity and cycle time to change processes, which will change dramatically. Second, the explosion of data will make advanced data skills a core requirement of finance organisation. Third, it will create capacity for finance professionals to become true business partners – a relationship for which both sides have always wished. However, wanting to be a good business partner and being one are two different things. It requires the kind of communication, tolerance for ambiguity, explorative mind-set, and collaboration skills which finance courses seldom focus on around the world.

So welcome to the world of many more process modellers, data scientists, risk managers, and business partners, as well as a significantly reduced set of data processors, analysts, accountants, and controllers. Every finance person has wanted these more strategic roles for a long time yet only a few are ready to make the leap. That is where the challenge will lie for organisations and finance leaders.

See also: To Deliver on AI’s Promise, Take the Brain from the Jar