It could become the biggest acquisition in the history of the semiconductor industry, but more than a year after it was announced, Nvidia’s planned $40bn takeover of British chip design giant Arm hangs in the balance.

The proposed blockbuster deal is facing regulatory scrutiny around the world, with rival tech companies almost uniformly opposed to the takeover, which would bring together Arm’s prowess for designing low-power, high-performance semiconductors with Nvidia’s expertise in the GPU space.

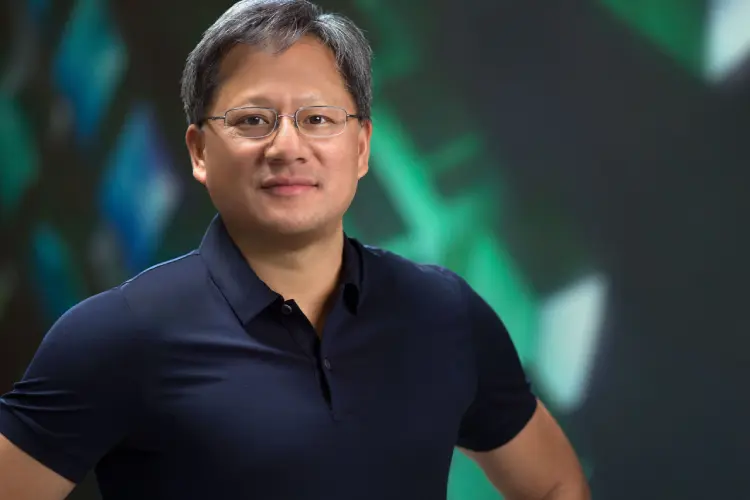

Nvidia’s $40bn take-over of Arm hangs in the balance as regulators investigate (Photo Illustration by Pavlo Gonchar/SOPA Images/LightRocket via Getty Images)

Arm, which is based in Cambridge and is currently owned by Japanese conglomerate SoftBank, has made its name as the “Switzerland of chip design”, licensing semiconductor IP to the biggest names in tech, such as Apple, Sony and Samsung without favouring any particular vendor. The fear raised by many in the industry is that the takeover bring the open licensing model to an end, handing a considerable advantage to Nvidia.

Will the Nvidia Arm deal happen?

This has piqued the interest of regulators around the world, and the scale of the challenge facing Nvidia as it seeks to complete the deal means chip industry experts are sceptical it will ever be closed. Alan Priestley, vice president analyst at Gartner, who covers the semiconductor industry, puts the chances of the takeover going through at less than 50%, while Linley Gwennap, president and principal analyst at the Linley Group, says the “chances of completion are low, but the deal isn’t completely dead.”

The length of time the process has been rumbling on could convince Nvidia to pull the plug, Gwennap says. “The problem is that the deal has already been pending for more than a year, and it now appears that it could take several more months to work through the process in the US and UK,” he tells Tech Monitor. “Given the poor odds, Nvidia may decide to withdraw its bid, assuming that there is some mechanism in the agreement for that.”

Could Arm do an IPO instead?

With SoftBank keen to divest the company and make a profit on the $24bn it paid for Arm when it took over in 2016, one possible future could be a return to the public markets. Arm co-founder and tech investor Hermann Hauser, who has been one of the most vehement critics of the Nvidia proposal, believes this is the best route forward for the company. Speaking to Tech Monitor in May, Hauser said a float backed by the UK government (the UK would invest £1bn and take a “golden share” in Arm, protecting it as a national asset) would be a “positive outcome” for Arm.

Gwennap says that if the Nvidia deal falls through, an IPO could be the best option for SoftBank, as “finding another buyer would be difficult”. “The Nvidia experience shows that a vertical merger will be difficult to approve, and no other IP supplier is large enough to acquire Arm,” he says. “The best option would be to relist it, but that could require some time to clean up the financials to make it more attractive (profitable) for public markets. So I expect SoftBank will be stuck with Arm for a while, and then try to IPO in 2023.”

Even if the Nvidia deal does go through, Gartner’s Priestley says Arm will not be a golden goose for its new owner due to the amount of investment its business model requires. “Arm’s business model makes it hard to accelerate growth, it needs ongoing investment to fund new IP,” Priestley says. “Even if Nvidia does acquire Arm, it is not going to drive significant growth for Nvidia.”

Here Tech Monitor outlines the key events so far:

European Union pauses Arm investigation

December 6 2021: The European Union decided to hit pause on its investigation into the Arm-Nvidia takeover. The closing date for submissions supporting or opposing the takeover was initially set for November 25, but the European Commission said it wants more time to gather information. Such delays in antitrust investigations have become common during the Covid-19 pandemic as companies deal with staff shortages, Reuters reported.

US FTC delivers blow to Nvidia’s ambitions

December 2 2021: In the most significant regulatory intervention to date, the US FTC announced that, following its investigation, it was suing to block the takeover.

“Tomorrow’s technologies depend on preserving today’s competitive, cutting-edge chip markets,” said FTC Bureau of Competition director Holly Vedova. “This proposed deal would distort Arm’s incentives in chip markets and allow the combined firm to unfairly undermine Nvidia’s rivals.”

An administrative trial will now take place where an administrative law judge will consider the merits of the takeover and issue a final decision. This is scheduled to start on August 9 2022, meaning Nvidia’s initial 18-month timeline for completion of the deal will be extended by at least several months.

UK moves a step closer to blocking Arm deal

November 16 2021: The UK’s probe into the Arm-Nvidia deal moved on to what is known as a “Phase 2” investigation, new DCMS secretary Nadine Dorries announced.

DCMS secretary Nadine Dorries will make the final decision on whether the UK blocks the Arm-Nvidia deal. (Photo by Dan Kitwood/Getty Images)

The 24-week investigation will be carried out by the Competition and Markets Authority (CMA), which will then deliver a report to Dorries outlining the impact the deal will have regarding antitrust and national security. It could recommend that the takeover be blocked, with the final decision then resting with the DCMS secretary.

European Union competition investigation opens

October 27 2021: Given its ambition to grow Europe’s domestic semiconductor capabilities, it was inevitable the European Union would also take a close interest in Arm’s future.

Announcing an investigation into the takeover, citing fears about the damage it could do to competition in the market, European Commissioner Margrethe Vestager said: “While Arm and Nvidia do not directly compete, Arm’s IP is an important input in products competing with those of Nvidia, for example in data centres, automotive and in Internet of Things. Our analysis shows that the acquisition of Arm by Nvidia could lead to restricted or degraded access to Arm’s IP, with distortive effects in many markets where semiconductors are used.”

The commission’s investigation would aim to “ensure that companies active in Europe continue having effective access to the technology that is necessary to produce state-of-the-art semiconductor products at competitive prices,” Vestager added.

Cambridge-1 supercomputer launches

July 8 2021: Despite continuing uncertainty over the Arm takeover, Nvidia launched the promised Cambridge-1 supercomputer, a machine offering peak performance of 9,682 TFlop/s. This made it the 41st most powerful supercomputer in the world.

The machine will primarily be used by the life sciences sector to discover and refine new drugs. Launch partners for the system include pharmaceutical firm AstraZeneca, King’s College London and fast-growing biotech scale-up Oxford Nanopore, all of which had been using Cambridge-1 as part of their work.

IPO a no-go says Arm CEO

July 2 2021: With regulators circling, many chip industry insiders started to speculate that SoftBank would pull the plug on the deal with Nvidia and instead re-list Arm on the public markets. However, Arm CEO Simon Segars poured cold water on this idea.

In a blog post on the company site, Segars said: “The combination of Arm and Nvidia is a better outcome than an IPO. The level of investment that will be needed to lead in AI will be unprecedented. We’ve been down this road before when we predicted a major market shift in 2016. We knew that we needed to invest heavily in our products, talent, and technology to take advantage of the opportunities ahead. The initial investments came when SoftBank acquired Arm; it enabled us to build new technologies that expanded our reach into data centres, the automotive and networking industries, all while retaining our leadership in mobile.”

He added: “Now is the time for us to take our scale to the next level to address the technology challenges ahead. We contemplated an IPO but determined that the pressure to deliver short-term revenue growth and profitability would suffocate our ability to invest, expand, move fast and innovate.”

Nvidia requests Chinese investigation

June 8 2021: China is one of Arm’s largest markets, so getting its approval for the deal will be key to its completion. The Financial Times reported that Nvidia had written to Chinese antitrust authorities requesting they review and green light the takeover.

Chinese chipmakers rely heavily on Arm designs, and the FT reported leading manufacturers such as SMIC and Hi Silicon oppose the takeover because of the increased control the US would have over these designs. Chinese lawyers familiar with the antitrust review process said it could take up to 18 months.

UK launches formal take-over probe

April 20 2021: To no one’s surprise, the CMA announced a formal investigation into the deal on “national security grounds”. A government statement said then-Secretary of State at the department for culture, media and sport (DCMS), Oliver Dowden, had taken the decision after considering “advice received from officials across the investment security community”.

The investigation into the Nvidia Arm takeover opened immediately, and would run until July 30.

Tech giants raise objections

February 12 2021: Despite repeated denials from Nvidia that Arm’s neutral status would be impacted by the takeover (“We love the business model. It will stay open and fair and we’ll offer even more IP,” said CEO Huang in response to critics), other tech firms seemed less than convinced.

As the US Federal Trade Commission (FTC) opened an investigation into the deal, Bloomberg reported that Google and Microsoft, along with chipmaker Qualcomm, had all contacted the FTC to object to the deal on the grounds that it would harm competition in the sector.

UK government scrutinises impact on Arm’s neutrality

January 8 2021: The first regulatory interest in the takeover came from the UK government through the Competitions and Markets Authority, which invited third parties to comment on the impact of the deal on the UK chip market. The CMA said it planned to look at whether Arm would have “an incentive to withdraw, raise prices or reduce the quality of its IP licensing services to NVIDIA’s rivals” if the takeover went through.

“We will work closely with other competition authorities around the world to carefully consider the impact of the deal and ensure that it doesn’t ultimately result in consumers facing more expensive or lower quality products,” said the CMA’s chief executive Andrea Coscelli.

Nvidia announces planned $40bn Arm acquisition

September 16 2020: After several weeks of speculation, Nvidia revealed its plan to purchase Arm from SoftBank for $40bn. “Uniting Nvidia’s AI computing capabilities with the vast ecosystem of Arm’s CPU, we can advance computing from the cloud, smartphones, PCs, self-driving cars and robotics, to edge IoT, and expand AI computing to every corner of the globe,” said Nvidia CEO Jensen Huang.

Perhaps anticipating opposition to the deal, Huang threw in a couple of sweeteners to try and woo the UK government; a new supercomputer, Cambridge-1, to be built and based in Britain to support life science research, and a new AI research centre to be built in Cambridge, near Arm’s headquarters.

Huang added that he expected the takeover to take up to 18 months to complete.