When Beijing halted Ant Group’s IPO last year, it was seen as retribution against founder Jack Ma. It was said Ma had become too publicly critical of the government and needed to be brought to heel, but several months later it is clear that, far from an isolated rebuke, the incident was the opening salvo in a regulatory crusade against China’s tech industry.

This year, Beijing has fined Ant’s parent company, Alibaba, a record $2.8bn, introduced new data security legislation (seen as intentionally targeting “China’s Uber”, ride-hailing app Didi), hinted at a crackdown on foreign investment in Chinese companies, and ordered the country’s multi-billion-dollar ed-tech industry to stop making profits.

Since November, Chinese regulators have taken 50 actions concerning antitrust, finance and data security, according to a report from Goldman Sachs released in July. As a result, nearly $1trn has been obliterated from the value of Chinese companies since February this year.

Chinese tech regulation: multiple crackdowns or coordinated assault?

The actions by Chinese regulators might appear like a coordinated assault on the tech industry, but “it’s better to understand what’s going on as multiple simultaneous crackdowns happening in parallel”, says Trey McArver, an analyst at Trivium China.

“There are multiple factors driving the various crackdowns, including a genuine desire to better regulate the monopolistic power of China’s tech giants; an effort to ensure that private business is contributing to overall national development goals; a need to ensure data security; and a broader push to address inequality.”

There may be legitimate antitrust cases against both e-commerce giant Alibaba and internet services company Tencent, which have both reduced choice and interoperability for consumers, and locked in smaller merchants with exclusivity deals. Ant Group had built its fortune on easy consumer lending with little public scrutiny. All of these practices would also fall foul of western regulators, too.

But some of the issues targeted by the regulatory onslaught are unique to China. The country’s online tutoring market had topped more than $100bn thanks to fierce competition in academic achievement. But the Chinese government is concerned that the cost of raising a child is putting citizens off from having kids – presaging a population decline that could imperil the country’s future.

In an attempt to even the playing field between wealthy and poorer parents, Beijing banned firms that teach school curriculum subjects from making profits, listing on stock exchanges or raising capital. It will also prevent these firms from accepting foreign investment.

The last point has implications beyond ed-tech. Although foreign investment is officially illegal in many sectors, complex structures called variable interest entities (VIEs) have allowed Chinese companies to raise money internationally. These investment vehicles let investors buy shares in a holding company, typically domiciled in the Cayman Islands, that yields payouts but has no operational control.

Although the Chinese government has typically turned a blind eye to VIEs, it has now explicitly said the funding route will no longer be permitted in the ed-tech sector – hinting that it could be ready to crack down on VIEs in other sectors too.

Meanwhile, Beijing has introduced new data-privacy regulation for Chinese consumers, said to resemble the EU’s GDPR. The new Personal Information Protection Law forces tech companies to obtain users’ consent before collecting their data and allows users to withdraw consent at any time. The law also prevents tech companies from transferring Chinese citizens’ data to foreign territories without government go-ahead. Any firm with more than one million users that plans to list abroad must now undergo a cybersecurity review too, the likes to which Didi is currently being subjected.

“China would like to prevent the abuse of data power by private parties and to protect national security,” says Ji Ma, senior lecturer in law at Peking University. “Accelerated by the forced, but failed, sale of TikTok under pressure from the United States, China has realised the mounting risks of data security, [which is a] part of national security.”

Under Trump, the US Congress passed the Holding Foreign Companies Accountable Act – legislation that will force Chinese companies with US listings to undergo auditing by US regulators. The regulation has continued to progress under Biden, with the SEC saying in March it would be prepared to enforce the audits. Fears that this would open Chinese companies’ sensitive data to inspection by the US, could be motivating some of Beijing’s latest actions.

The bigger agenda behind Chinese tech regulation

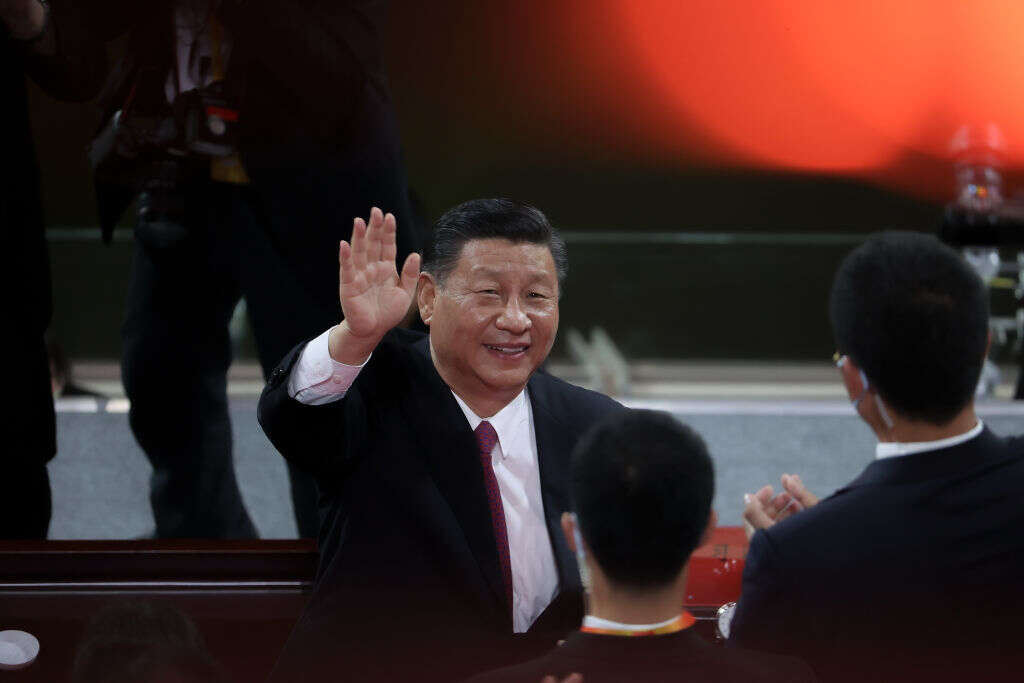

Beyond the geopolitical stand-off with the US, there are signs that China’s seemingly destructive actions are in the service of a higher agenda. Late in 2020, President Xi Jinping claimed that 2021 would signal the beginning of a new phase for China where national security, “common prosperity” and social stability would be prioritised over rampant growth.

While striking out at its hugely profitable tech giants, Beijing has also declared its intention to “regulate excessively high incomes and encourage high-income groups and enterprises to return more to society”. In response, Tencent has already said that it will create a 50bn yuan fund to help achieve “common prosperity”.

More than anything, the Chinese government’s recent actions signal “the ambition of the [Chinese Communist Party] to regain control over the ‘heights of the economy’ which now includes the digital economy in a way that was not the case 20 years ago,” says Jonathan Liebenau, associate professor in technology management at LSE.

Because of the economic benefits wrought by thriving tech businesses, “the success of some of them was heralded, even as their growth pushed against economic rules and guidelines”, says Liebenau. “For example, laws about the number of employees, about ownership and the structures of corporate governance, about the role of CCP involvement in local planning and practice, were all stretched as the most successful companies grew.” After a period of relatively lax regulatory enforcement, China is seeking to bring tech giants back in line.

Another theory is that China wishes to clamp down on parts of the tech industry it sees as dispensable, such as online gaming, social media and the wider platform economy, and bolster more strategically useful sectors such as high tech manufacturing, in line with its industrial policy.

“Previously, the booming China internet industries did stimulate consumption and promote economic growth; however, these internet industries are not real high tech, demonstrated by the fierce China-US trade war,” says Ma. “In the face of the US sanctions against Chinese entities, China learned that the US really wants to prevent China owning real high tech, such as semiconductors.”

In the face of growing US pressure on semiconductor supply chains and sanctions against Chinese companies, China announced last year that it plans to build up its domestic semiconductor industry. The goal, supported by a multibillion-yuan government stimulus plan, is to make 70% of its semiconductors domestically by 2025, up from a third today.

Will China’s tech strategy succeed?

There is evidence that if China’s strategy is to divert investment into strategic sectors is working. Investors are reportedly pivoting from e-commerce to Chinese chip, software and biotech groups – all areas that have been earmarked as high priority by the government. According to the Financial Times, the value of venture capital investment into Chinese semiconductor firms increased 446% in the second quarter of 2021 compared with the first, while during the same time investments in gaming and e-commerce companies plunged 96% and 54% respectively.

But some experts dispute China would need to take such drastic actions to try to direct funding. “China can, as the old American phrase goes, walk and chew gum at the same time,” says William Kirby, a Harvard professor who specialises in Chinese business studies. “So I don’t see this as an either-or proposition.”

The short-term consequences of China’s actions have been knocking billions off the valuation of Chinese tech companies and spooking international investors. This could even make Chinese companies less globally competitive in the long term, which could end up benefiting western firms says Michael Witt, a senior affiliate professor of strategy and international business at Insead business school in Singapore. But at the same time, “China will not destroy Big Tech,” he says. “It is just getting it under control.”

China will not destroy Big Tech, it is just getting it under control Professor Michael Witte, Insead

Countries in the West have increasingly sought to rein in Big Tech. The EU is a self-described world leader in tech regulation, but it hasn’t been able to act as swiftly or decisively as the Chinese government. EU investigations into Silicon Valley giants tend to last years. China’s case against Alibaba was completed within months.

Could China’s actions offer any inspiration to the West? “The West is caught [out]; on the one hand, tech needs regulating, urgently,” says Witt. “On the other hand, the West needs large tech firms to be able to compete, not just economically, but also geopolitically.”

Fundamental differences between the US and China’s economies complicate matters. “The US Big Tech can mobilise social forces, litigate against the US government, or lobby the US legislature to promote their own interests,” points out Ma. “In China, seldom can corporations, including Big Tech, affect Beijing’s decision once Beijing is determined to achieve something meaningful.”

There are signs that the US is attempting to rectify its lack of funding into strategic sectors such as high-tech manufacturing. Congress voted to bring in the Innovation and Competition Act this year, which invests $250bn into areas such as semiconductor manufacturing, AI and quantum computing.

But there is uncertainty over how successful western efforts to mimic a Chinese approach to subsidising industries will be. “We don’t really have the legal mechanisms to do that,” says Liebenau, without violating WTO rules or industry subsidy rules or competition rules. “There doesn’t seem to be a mechanism for the US Treasury to just give $50bn to Intel or Texas Instruments or Nvidia or Skyworks or AMD.” There’s also hypocrisy in the West taking this approach, he points out, after berating China for years about its own industry subsidies, which are likely in contravention of WTO rules.

Instead, funding to strategic tech sectors in the US and other western countries will likely “happen in the context of military budgets,” says Witt, who forecasts a major conflict on the horizon between the US and China. “In a context like that, countries have no choice but to invest in strategic industries so as to increase their military power.”