Japan has placed restrictions on the sale of semiconductor manufacturing equipment. The country hasn’t explicitly said the move was aimed at China, just that it is about “fulfilling our responsibility as a technological nation to contribute to international peace and stability,” and to prevent its use in military purposes. It follows similar moves by the US and the Netherlands to restrict the sale of advanced technology to China.

President Joe Biden has introduced a number of export controls designed to stop Chinese companies buying advanced chips made in the US, as well as equipment foundries need to design their own chips. He has also encouraged other companies with chip manufacturing capabilities to follow suit.

The new ruling in Japan includes restrictions on 23 types of semiconductor manufacturing equipment which is aligned with the US export rules. It means companies such as Nikon and Tokyo Electron will need export permission for all regions before shipping equipment overseas.

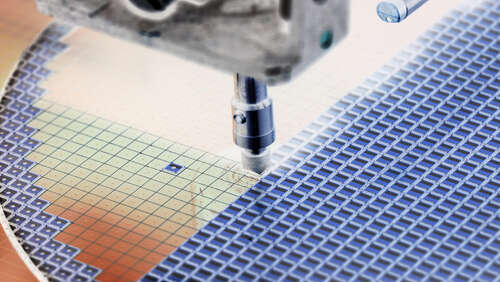

The new export controls will come into force from July across six categories of equipment widely used in chip manufacturing including cleaning, deposition, etching and lithography. This means if a country, such as China, is on an export ban list then they would “lose access to more products from Japanese companies” than just chipmaking tools.

The new controls are likely to affect at least a dozen companies across the full chipmaking supply chain but minister for economy, trade and industry, Yasutoshi Nishimura said it would have minimal domestic impact.

The problem, said Takamoto Suzuki, head of economic research at Marubeni is that there isn’t a strong domestic chip market in Japan so these companies rely on exports. Speaking to Reuters Suzuki said, “it will undermine the market development of Japanese companies and certainly reduce their competitiveness from a regulatory aspect”.

Goal is to slow China’s growth

Japan has seen a gradual decline in its market position when it comes to chip production, now controlling about 10% of the global market, but it is still a major supplier of the machines used to make the chips as well as the related materials. For example, a fifth of the world’s chipmaking tools are produced by Tokyo Electron and Screen and most silicon wafers are made by the Shin-Etsu Chemical Company and Sumco Corp.

The US imposed restrictions on the export of chipmaking tools in November last year in an attempt to slow down the growth of China’s chip industry over concerns it would benefit the Chinese military. This included the sale of AI chips and technology. Since then it has been working to convince its chipmaking competitors in the Netherlands and Japan to follow the ban.

Dutch business ASML is the only company in the world capable of making the extreme ultraviolet (EUV) photolithography machines used in the manufacturing of semiconductors. As such, it supplies all the biggest names in the industry, from TSMC to Samsung to Intel.

Earlier this month the Dutch government confirmed it would impose export controls on this type of equipment to China following increased pressure from the US. With Japan also signing on, it means the only three countries home to manufacturers of microchip printers have put blocks on exports to China.

In all three countries, companies producing the most advanced equipment can still export around the world but need a special licence to do so and permission from the government to export to “high-risk” countries.

The US has ramped up restrictions through 2022 and companies such as Nvidia and AMD have been hit the hardest, including making significant changes to their operating models to avoid buying from or selling advanced equipment and chips to China.