Arm is planning to sell AI chips by 2025. According to Nikkei, which broke the story, the UK-based chipmaker will create a dedicated AI chip department and build a prototype by the spring of next year, with mass production beginning by autumn. Specialising in creating chip architectures for firms like Nvidia and Intel, Arm is the latest semiconductor player to commit to creating AI chips, which promise to facilitate faster and more expansive training regimes for large language models. In response to a request for comment from Tech Monitor, the firm remained tight-lipped, stating that it did not “comment on rumor and speculation.”

The news appears to be the culmination of efforts earlier this year by Softbank to create its own AI chip venture. Codenamed “Izanagi” after the creator god of Japanese mythology, the project aimed to raise $100bn from a variety of investors across the Middle East. The successful realisation of that project would, in theory, allow it to reduce its dependence on chip giants like Nvidia, which is likely to supply the silicon necessary to support the $960m expansion of Softbank’s computing facilities that the investment company announced in April.

Arm key to making Softbank AI giant

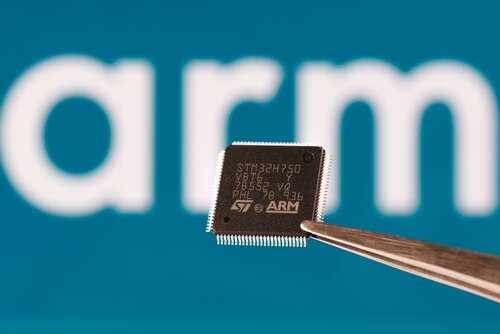

Claiming a market share of 90% in the provision of processor architecture for smartphones, Arm was bought by Japan’s Softbank for £24bn in 2016. After successfully listing the chip design firm on the New York Stock Exchange last year, its owner’s chief executive, Masayoshi Son, is reportedly interested in leveraging the UK company’s expertise toward making Softbank a centre for AI excellence and scaling back its sprawling investments in smaller technology startups around the world – the latter decision contributing to the $2.11bn quarterly profit it announced this morning.

According to Nikkei, Arm’s venture into AI chip design will see the chip design firm cover most of the initial development costs. If the experiment is successful, the resulting unit might then be separated from Arm and placed under the direct supervision of Softbank. Its chief executive has been evangelical about the possibilities entailed by artificial general intelligence, which many semiconductor experts believe can only be facilitated through new and innovative chip designs.

“When you ask them about a detailed definition, a number, the timing, how much computing power, how much smarter AGI is than… human intelligence, most of them don’t have an answer,” Son told a quorum of Japanese investors in October 2023. “I have my own answer: I’m convinced AGI will be real in 10 years.”

Rising demand for chips capable of facilitating high-intensity AI tasks

An umbrella term for semiconductors like graphics processing units (GPUs), application-specific integrated circuits (ASICs) and field programmable gate arrays (FPGAs) capable of performing AI tasks efficiently, new AI chips have been announced by numerous companies over the past six months. These include AMD and Nvidia, both of which have launched a succession of chips they claim are capable of speeding up the time it takes to train new models and allowing them to be run locally on desktop computers.

Rising demand for AI chips has also boosted the fortunes of specialised manufacturers lower down the supply chain. Earlier this month, SK Hynix announced that its entire roster of high-bandwidth memory chips had sold out for this year, with none available until late 2025 – a contributing factor toward its second-highest operating profit ever following five consecutive quarters of net losses.