Intel revealed its blueprint for the future yesterday, with plans to open two new semiconductor foundries in the US and build chips for some of the biggest names in tech. The move could go some way to addressing structural imbalances in the global chip supply chain, but is also a recognition from Intel that it needs to change its business model and rethink its relationship with rival firms.

New CEO Pat Gelsinger introduced the strategy, known as IDM 2.0 (IDM stands for integrated device manufacturing), at an online event on Tuesday, his first major public speech since returning to Intel from VMWare last month. Gelsinger has been brought in to reinvigorate Intel, which has stagnated in recent years, losing its position as the most valuable US chipmaker to Nvidia, and seeing Taiwanese firm TSMC enjoying the lion’s share of the manufacturing market.

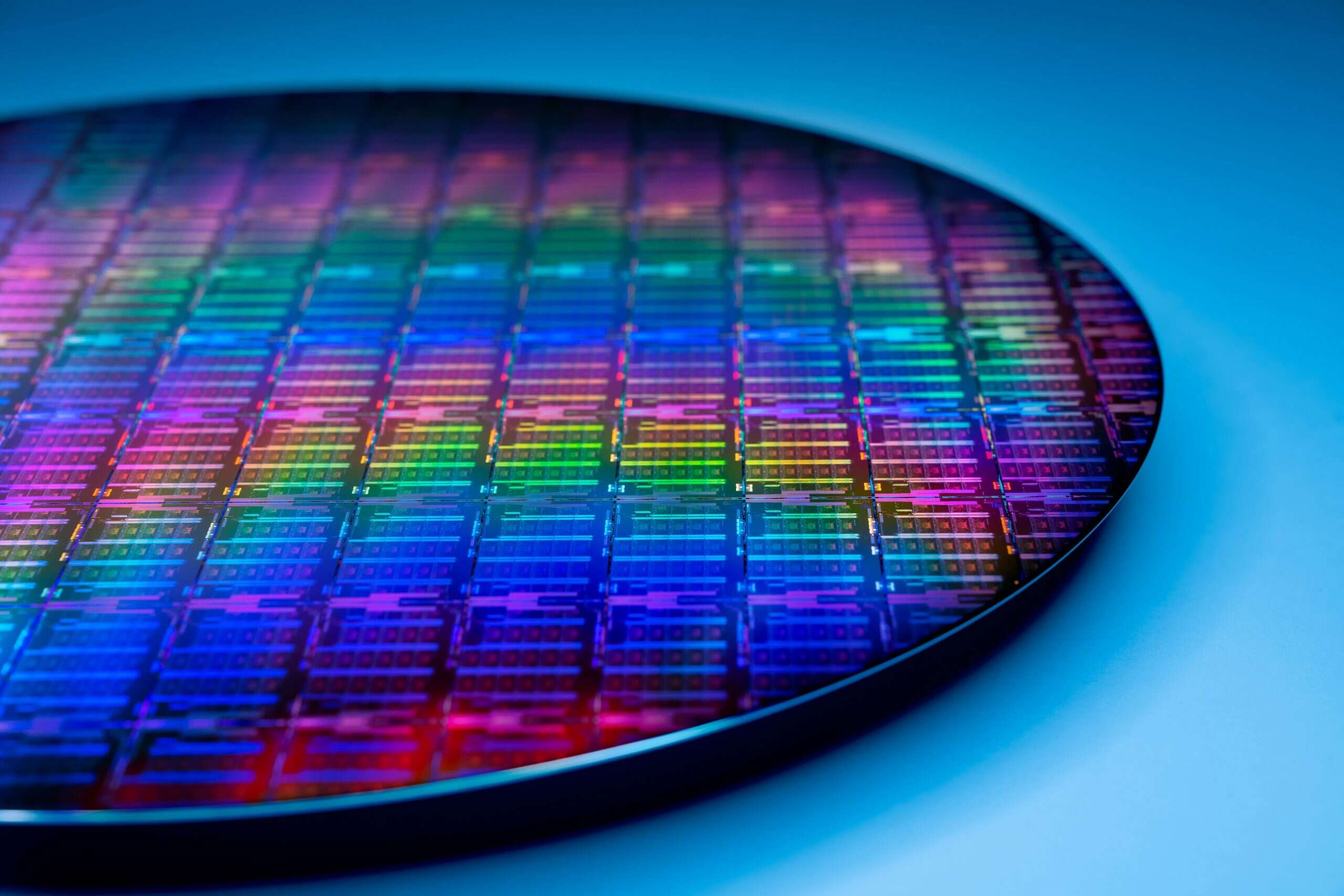

Gelsinger’s plans are, on the surface at least, ambitious. Intel will invest $20bn in two new semiconductor foundries, or fabs, at the company’s campus in Ocotillo, Arizona, scheduled to come online in 2024. These fabs will build seven-nanometer (nm) chips for third parties, utilising Intel’s x86 architecture and other architectures like Arm and RISC-V, as well as bringing Intel’s own designs to life. It is the first time the company has moved into manufacturing for a third party.

“Intel is the only company with the depth and breadth of software, silicon and platforms, packaging, and process with at-scale manufacturing customers can depend on for their next-generation innovations,” said Gelsinger at yesterday’s announcement, describing IDM 2.0 as the kind of “elegant strategy only Intel can deliver”. But delivering has become a problem for Intel in recent years, having experienced manufacturing delays on its 10nm semiconductors, while its 7nm designs have yet to hit the market for similar reasons. Elsewhere, rival firms like AMD are already selling 7nm devices and are looking to next-generation 5nm chips. Shareholders and customers alike will be hoping Gelsinger and his team can make good on their promises.

Intel manufacturing strategy could help rebalance the chip supply chain

As reported by Tech Monitor, the world is currently in the grip of a chip shortage affecting many major industries, caused in part by the fact that the vast majority of the world’s semiconductors are manufactured in South East Asia. Data from TrendForce shows that only 13% of chip foundries are based outside the region, with 81% of fabs based in two countries – Taiwan and South Korea.

This reflects the dominance of the chip manufacturing market by two businesses – Taiwan’s TSMC and South Korea’s Samsung, which supply the vast majority of the world’s advanced semiconductors used in high-end consumer electronics and military applications. Intel wants to change this, and its new fabs will come under the remit of a new division of the company, Intel Foundry Services, which will also aim to build out manufacturing capacity in Europe, with the objective of creating a more balanced chip supply chain where risk is spread around the world. This ambition fits nicely with new President Joe Biden’s plan to build out US manufacturing capacity – the US currently only makes around 12% of the semiconductors it uses.

Gelsinger’s gambit: born of necessity

Industry analysts say Gelsinger’s plans to get Intel moving are a pragmatic response to the company’s predicament. “Critics would argue that elements of this strategy aren’t new,” says Geoff Blaber, CEO of research firm CCS Insight. “Intel has talked about opening its manufacturing capability to customers for years but failed to make any considerable progress. Gelsinger needs to prove that this time it’s different.”

Gelsinger said at the IDM 2.0 launch that Intel is aiming to build chips for US tech firms such as Microsoft, Amazon and Google, all of whom are developing their own in-house semiconductor designs that will be manufactured at third-party foundries. The trio were among a host of big names to endorse the new Intel strategy, along with Qualcomm, Ericsson, Cisco and IBM, with Microsoft CEO Satya Nadella making a guest appearance at the event to give Gelsinger’s plans the thumbs up.

How deep these relationships run remains to be seen, but what is certain is that TSMC will not give ground easily. “TSMC is scheduling a 5nm plant in the US by 2024, in the same time frame as the two new Intel foundries,” says Mike Orme, thematic research consultant at GlobalData, who specialises in the semiconductor industry. “Intel claims that its 7nm process technology is equivalent to TSMC’s 5nm.” The big prize could be Apple, which is a former customer of Intel but is transitioning over to its own silicon, the Arm-based Apple M1, over the next two years. TSMC is currently manufacturing the M1, but Gelsinger will be hoping to tempt Apple back onto familiar territory if Intel’s new fabs prove a success.

While Intel is aiming to knock TSMC off its perch in the long term, in the short term it will be giving its rival more business, having also announced it will be expanding its use of third-party manufacturers to ensure that its chips can remain at the forefront of technological development while it brings its in-house manufacturing capabilities up to speed. Blaber adds: “Intel is adapting its model and acknowledging competitors strengths yet doubling down on the areas where it leads. This is a new pragmatic Intel born of necessity.”

Home page image courtesy of Intel.