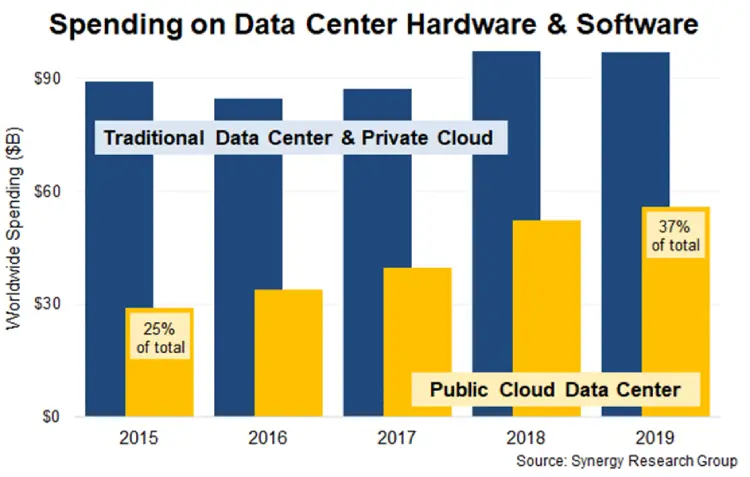

Global data centre spending on hardware and software climbed to over $150 billion (£125 billion) in 2019, according to the latest figures from Synergy.

Spending on public cloud data center hardware and software grew seven percent, while that for on-premises and private cloud fell by one percent.

Public cloud data centres now account for 37 percent of total data centre hardware and software spending, Synergy said; up from 25 percent in 2015.

The spending breakdown spans servers, OS, storage, networking, virtualisation software, network security and management software.

Servers were, by some margin, the largest product category and accounted for 46 percent of hardware and software spending in 2019.

Q4 market leaders were Dell, Microsoft, HPE and Cisco.

They were followed by Huawei, IBM, VMware, Inspur and Lenovo.

In the public cloud segment, ODMs again accounted for the biggest share of the market, with a year-end spike in shipments to hyperscale operators.

The news comes a month after data centre real estate consultancy CBRE reported that the four largest co-location markets of Frankfurt, London, Amsterdam and Paris (“FLAP”) meanwhile hit a combined 201MW in take-up in data centre capacity in 2019 – a new European record, driven by hyperscalers (major cloud providers).

“Cloud service revenues grew by 39 percent in 2019, enterprise SaaS revenues grew by 26 percent, search/social networking revenues grew by 20 percent, and e-commerce revenues grew by 24 percent, all of which helped to drive increases in spending on public cloud infrastructure,” said Synergy’s John Dinsdale.

“Meanwhile, enterprise spending on their own data centers is being crimped by the shift in workloads to public clouds. We are already seeing server shipments to public cloud providers outstripping shipments to enterprises.”

CBRE’sMitun Patel told us last month: “As the hyperscale companies roll out their services more widely… the rate of hyperscale procurement of data centre capacity in other European cities will increase rapidly. As a result, markets such as Madrid, Milan, Warsaw and Zurich, will witness a substantial increase in colocation activity.”

Coronavirus-driven recession or no, major procurement looks set to continue as data centre providers ramp up capacity to support surging cloud demand.