Brexit is rapidly emerging as a potential systemic risk to the global financial system, according to a new “risk barometer” [pdf] by the Depository Trust & Clearing Corporation (DTCC), a centralised clearinghouse for more than 50 global financial market exchanges and equity platforms.

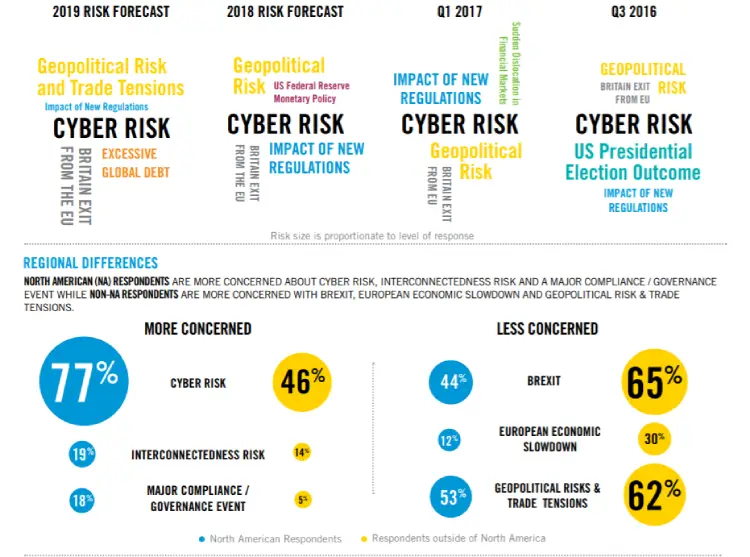

But despite the UK’s exit from the European Union being the most significant advancer (+11 percent) and #3 overall risk in the annual survey, if there is one threat that keeps the global financial services sector up at night, it continues to be cyber risk; still the number one cause for industry concern.

IMF research [pdf] this summer suggested average annual potential losses from cyber-attacks may be close to nine percent of banks’ net income globally, or around $100 billion. (The Fund acknowledges that major data gaps on cyber risk make the estimate challenging and anticipates GDPR to help with transparency).

What is the DTTC?

The DTTC is the primary post-trade market infrastructure for the global financial services industry and sits at the center of securities trading activity, where it processes approximately 90 million financial transactions every day.

Its depository provides custody and asset servicing for securities issues from 131 countries and territories valued at $57.4 trillion. It has published the “pulse check” annually since 2013.

See also: Bank of England Tests Cybersecurity Resilience with War Game Exercises

Last year’s survey also ranked cyber risk as the number one cause of systemic risk, with a record high of 78 percent of respondents ranking it a key concern. That’s down to 69 percent this year. Excessive Global Debt, included as a risk category for the first time, ranked as the #4 overall risk.

“The broad perspective of these survey results shows that while economic indicators continue to appear strong, pockets of weakness are starting to appear across numerous components of the financial system as geographic flash points continue to materialize and intensify,” stated Michael Leibrock, DTCC’s Chief Systemic Risk Officer.

He added: “It is critical that firms continue to remain vigilant to anticipate and prepare for not only these emerging risks, but the potential cascading effects that may arise from an increasingly interconnected financial system.”