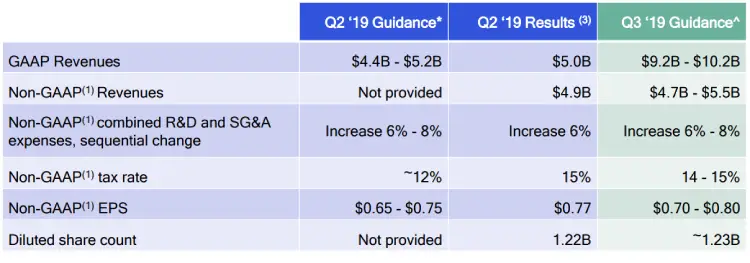

Even though its revenue fell by five percent year-on-year to $5 billion, Qualcomm posted an encouraging second quarter with an earnings call that revealed a future $4.7 billion windfall after settling litigation with Apple.

In its second quarter results California-based mobile technology giant Qualcomm saw operating costs rise of 135 percent year-on-year to $900 million (£688), in large part as litigation costs stung the company.

Analysts on an earnings call were keen to dig deeper into the announcement that Apple will pay Qualcomm somewhere between $4.5 to $4.7 billion in a settlement agreement which was reached last month, bringing an end to the lawsuit merry-go-round between the two businesses.

Read this: Qualcomm’s 20 Bad “Apples”: Litigation Weighs on Chip Giant

Dave Wise SVP Finance at Qualcomm told them: “The $4.5 billion to $4.7 billion is all for resolution of things prior to the effective date of the agreement. So it’s all past. We’ll recognize it one-time as revenue in Q3 in our GAAP results. And then, our go-forward guidance on QTL includes the forward impact of ongoing royalties from Apple starting in Q3.”

Qualcomm CEO Steve Mollenkopf reconfirmed that the financial settlement reached with Apple also includes two long-term agreements. Moving past their bitter disputes Qualcomm and Apple have agreed to a global patent licensing agreement and a multi-year chipset agreement.

The global patent licensing agreement is for six years with an additional two years if Apple wishes to extend it. Mollenkopf called it a ‘significant milestone’ as it is the first patent agreement his company has signed directly with Apple.

This agreement is being highlighted by Qualcomm as indicator for strong growth ahead as it represent a ‘significant revenue and margin expansion for both our licensing and chipset businesses.’ Mollenkopf commented.

With regards to the chipset licensing agreement Qualcomm was tight-lipped on the details and stressed the need to “move on”.

“I’ll just remind you, there’s a lot of tension removed out of the system as a result of these settlements,” Mollenkopf stated.

Apple had been counting on Intel to provide its 2020 iPhone with a XMM 8160 5G multimode modem, but Intel dramatically excused themselves from smartphone 5G modem market just hours after the Apple settlement with Qualcomm.

Qualcomm’s CEO declined to drill down further into the chipset agreement, saying: “I’d say this maybe a little bit unsatisfying, but I’m not going to go through all the details other than to say on the chipset agreement it’s a multi-year agreement. I think both companies are happy with it. It’s something that at least the way we look at it from the QCT side or from the Qualcomm side is it provides lot of stability to our business.”

Qualcomm and the 5G Market

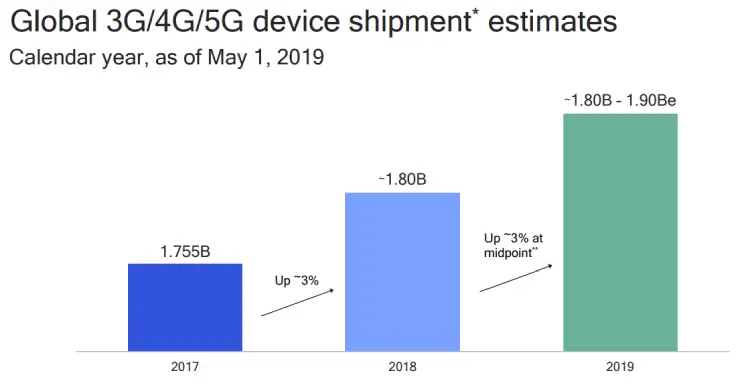

When it came to the 5G market Qualcomm is lowering its estimates by 50 million units for 2019, bringing estimate sales of devices in 2019 to 1.85 billion.

Qualcomm’s SVP of Finance Dave Wise cited “continued weakness in China and a lengthening of handset replacement cycle, potentially reflecting a pause in advance of 5G rollouts.”

Qualcomm’s position in the 5G marketplace remains strong, President Cristiano R. Amon was keen to emphasise: “[I’d] remind you all that we actually accelerated the timeline by one-year and we’ve been the silicon of choice in every single trial and development across infrastructure in operator and device. So it’s a very strong position consistent to what we saw the company doing in 3G and 4G.”

Never Ending Legal Issues

While one beast of a legal endeavour has been put to bed Qualcomm are not out of the courts yet as Qualcomm’s General Counsel pointed out: “We still have, obviously, are waiting for the judge to rule on the FTC case, which we won’t comment on.”

The FTC case is anti-trust investigation in relation to the way the company operated its licensing and patent operations.

Qualcomm is also in negotiations with Huawei over ongoing licensing issues in a similar vein to their troubles with Apple. However, unlike Apple, Huawei is in a far better position to source its own 5G and RF technologies.

Qualcomm has stated in a release that it will receive “$150 million of royalties due under an interim agreement with Huawei as minimum, non-refundable payments for royalties due for sales of licensed products by Huawei during the relevant quarter while negotiations continue” but the case continues.

Don Rosenberg concluded: “Clearly we were spending a lot of money and a lot of time in resources on the worldwide litigation with Apple. So eliminating all of that now is pretty much the — has been the key to getting us back in a normal litigation cadence.”

“We’ve got the normal amount of various patent cases and others around the world, but a couple of class actions that flowed from some of the previous allegations that are waiting to happen on the FTC and others. But it’s a dramatic decrease in the amount of litigation where they have to be managing over the next several years I think.”