The launch of a robo-adviser for mortages in the UK promises to slash mortgage application time to 15 minutes, while providing 60-second live mortgage matching.

The initiative involves a digital network that will promote and boost broker independence, while also coming fully integrated with the Experian credit files of homebuyers.

Mortgage Gym is behind the planned launch, claiming to be the first digital mortgage network that complies with the regulation set out under the Mortgage Market Review (MMR). Mortgage Gym also functions as a paperless business.

The MMR imposed rigorous and extensive ‘stress-tests’ on homebuyers following its 2014 introduction, and it is this that has contributed greatly to the rise of the robo-adviser.

Services provided will also include a whole-of-market overview of available rates across 90% of the mortgage market; with the intention of updating 15,000 mortgage products four times a day. The robo mortgage adviser is also aimed at granting the user access to support from brokers nationwide for final, live advice.

John Ingram, CEO and founder of Mortgage Gym, said: “By creating the world’s first, regulated mortgage robo-adviser, we aim to remove the guesswork, frustration and stress for homebuyers from one of the most important financial transactions in their life. For brokers, we believe our digital network will empower them to develop their own business with a steady stream of high-quality, prequalified clients without the burden of endless back-office compliance.”

READ MORE: Salesforce brings Einstein AI to Financial Services Cloud

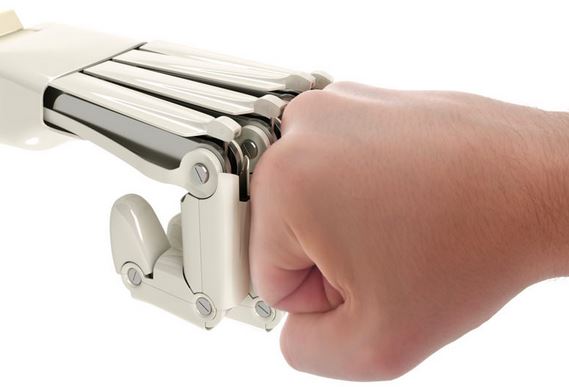

At a time when getting onto the property ladder is something of an odyssey in itself, it seems likely that many would appreciate an easy ride on the planning side of the equation. However, for others this will only confirm fears of jobs ultimately being lost to technological replacements within the financial services.

Adding further to the argument of the benefits of the service, Mr Ingram said: “Following tighter regulation of the mortgage market in 2014, we realised the UK’s mortgage application process is archaic, inaccurate, time-consuming and ripe for disruption from a holistic, online solution.”