Chip designer SiFive swelled its coffers last month with a funding round worth $175m, taking the total invested in the company to more than $350m. SiFive has rapidly become the biggest and best-known company developing chips built on RISC-V, an open-source chip architecture long touted as a rival to x86 and Arm, and has now set its sights on developing high-performance processors based on RISC-V.

The Series-F round, led by Coatue Management, values the company at $2.5bn, and is validation not only for SiFive but for the RISC-V ecosystem as a whole, according to SiFive CEO Patrick Little. “The market has spoken and made it abundantly clear that RISC-V computing will be competing for the heart of all future computing platforms,” Little said. “As the founder and market leader of RISC-V computing it’s our role to lead this ecosystem forward and offer customers an advanced computing alternative to Arm and others.”

It has been a busy few weeks for SiFive, which also disposed of OpenFive, its business unit working on chip connectivity, by selling it to Canadian company AlphaWave for $210m, leaving it free to focus on CPUs. With over $300m to play with, it is well-positioned to cement its position as the leading RISC-V chip developer, but faces increasing competition. Its success or failure could hinge on a strong relationship with the wider RISC-V community.

What is RISC-V?

Emerging in 2010 from the Parallel Computing Lab at UC Berkeley in California, RISC-V is a modular instruction set architecture (ISA) which allows developers to build chips on top of a core, openly available, instruction set.

It has gained in popularity in recent years, particularly since uncertainty began to grow around the future of Arm, the British chip designer which provided the blueprints for chips that power most of the world’s mobile devices. Arm was due to be sold by current owner, SoftBank, to another chip company, Nvidia, for some $40bn, raising questions about whether its vendor-agnostic licensing model would continue, but the plug was pulled on the deal in January after mounting regulatory problems.

Arm is set to be relisted on the public markets and remain an independent company, but despite this, Alan Priestley, VP analyst at Gartner, says the “damage has already been done”, and businesses are looking at alternatives, including RISC-V. “A lot of companies are looking at alternate sources of IP, maybe not switching totally away from Arm, but having the option of Arm or RISC-V in their products,” he says. “RISC-V was already gaining traction before SoftBank decided to try and offload Arm, and I think that has increased the focus of some of the semiconductor companies on RISC-V as an alternative.”

Indeed, the RISC-V Foundation, a non-profit organisation which oversees the ecosystem, counts some of the biggest names in tech among its members including Intel, which in February announced it had joined the RISC-V board and would be investing in the technology as part of its push to provide more foundry services to third parties.

The evolution of SiFive and its importance to RISC-V

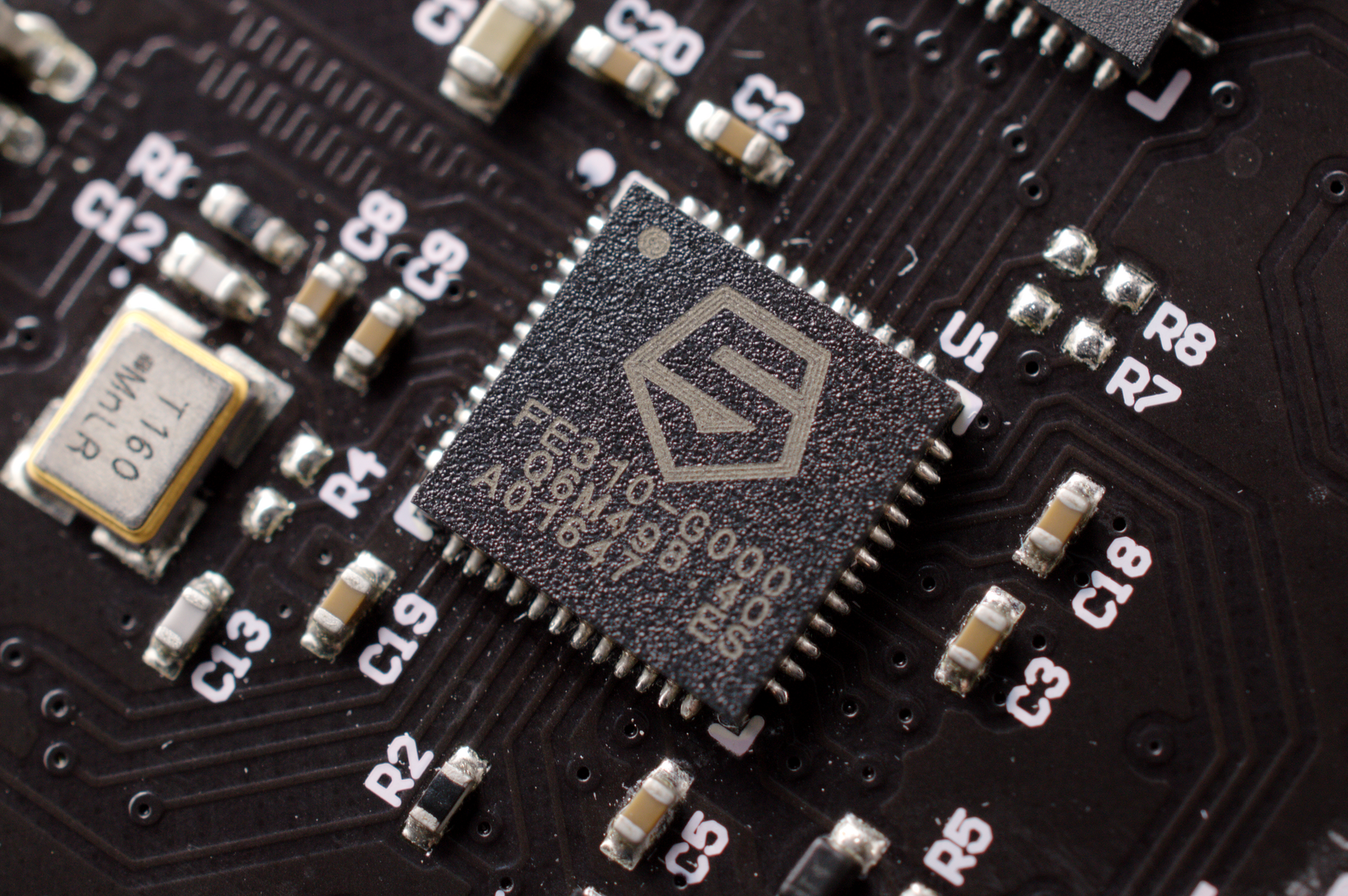

SiFive was set up in 2015 by Krste Asanović, Yunsup Lee, and Andrew Waterman, three of the Berkeley researchers who invented RISC-V. A fabless company, meaning it designs but doesn’t produce processors, it released the first commercial system-on-chip based on RISC-V, the HiFive development board in 2017. This first-mover advantage means SiFive is “the big player in the space”, says Steven Dickens, senior analyst at Futurum Research, and in the wake of its recent funding announcement the company claimed it has more than 100 customers around the world, with some of the public cloud hyperscalers and the top semiconductor manufacturers using its designs. As a private company, it doesn’t report revenue.

Little, a former Qualcomm executive, took up the role of CEO in 2020, and under his leadership SiFive has been focusing on producing high-performance CPUs. This focus is reflected in the company’s sell-off of OpenFive, says Dickens. “This is SiFive stating it has found what it is really good at, which is doing high-performance processor design, and it believes there’s a big addressable market that it can lay claim to,” he says. “So [AlphaWave] has come along and offered it a chunk of money for something it doesn’t consider an important part of its business, and together with the recent raise, it now has the funds to help it double down on its core focus.”

When SiFive’s chips will be able to match the performance of their Arm counterparts remains to be seen. The company’s most advanced chip, the 16-processor core P650, came out late last year, offering comparable performance to Arm’s Cortex A77 range which was released in 2019, but not the latest Arm designs, the Neoverse. Dickens says the recent investment could help narrow the gap. “They need to build out their team and increase their partner work,” he says. “Chip design is a capital-intensive space, but this is a relatively small company with a tight focus.”

Gartner’s Priestley believes RISC-V chips are some way off matching their Arm counterparts. “We’ve yet to see anything that could compete against the Neoverse, or the stuff that Apple and Ampere are doing at the high end of the Arm space, and we’ve yet to see a x86 class processor operating the RISC-V instruction set,” he says. “It’s possible, but it hasn’t happened yet.”

Apple has been working on its own high-performance chip designs for laptops and mobile devices, the M1 series, for the past two years. Ampere focuses on server chips and its top-of-the-range model, the Altra Max, boasts 128 processor cores.

Priestley adds that other businesses are developing RISC-V cores which could surpass those produced by SiFive. “SiFive is the company that has had a lot of noise recently, but there are others like Western Digital and Codasip who produce comparable RISC-V cores,” he says. “Imagination has just announced RISC-V cores and is targeting the advanced end of the market.”

The future of SiFive

Futurum Research’s Dickens believes SiFive is well-placed to succeed thanks to the growing RISC-V ecosystem. “There have been a lot of attempts to develop a third chip architecture to rival Arm and x86,” he says. “Where this stuff lives or dies is the ecosystem; the software support and the people architecting and writing software for it,” he says. “That’s why I believe SiFive will be successful, because it isn’t trying to lift RISC-V on its own. They are riding on the coat-tails of an ecosystem which has its own momentum. If SiFive went away, it would make a big dent in that ecosystem, but I think it would continue to grow without them.”

He adds that the geopolitical situation, and the growing importance of emerging markets such as India and China, mean the opportunity for RISC-V will also expand. “Chipmakers in these parts of the world potentially don’t want to take Intel or Arm’s approach,” he says. “If you’re an Indian start-up wanting to create a new chip, are you going to throw your lot in with a US company like Intel when it comes to R&D? Or are you going to choose to be part of an open-source community? In a geopolitical landscape that’s probably more fractured than it ever has been, I think an open-source chip architecture that’s not run by a Western company is appealing.”

This in turn presents more opportunities for companies like SiFive, even if the bigger chipmakers become more active in the space, Dickens argues. “SiFive is heavily involved in the RISC-V community, they sit on a bunch of its committees,” he says. “They’re heavily invested in trying to promote the project, and it may seem counterintuitive, but it helps them if bigger competitors start to take an interest because it validates the technology.”

He adds: “SiFive has got some deep pockets now, and some smart guys on the team. Now they need to go and execute.”