China is set to reveal a $143bn investment package to boost its semiconductor sector in the face of increasingly stringent sanctions imposed on Chinese chipmakers by the US.

The new incentives will reportedly be rolled out early next year, and will see China join the US in offering a significant fiscal package to support domestic chip production.

How will China support its semiconductor sector?

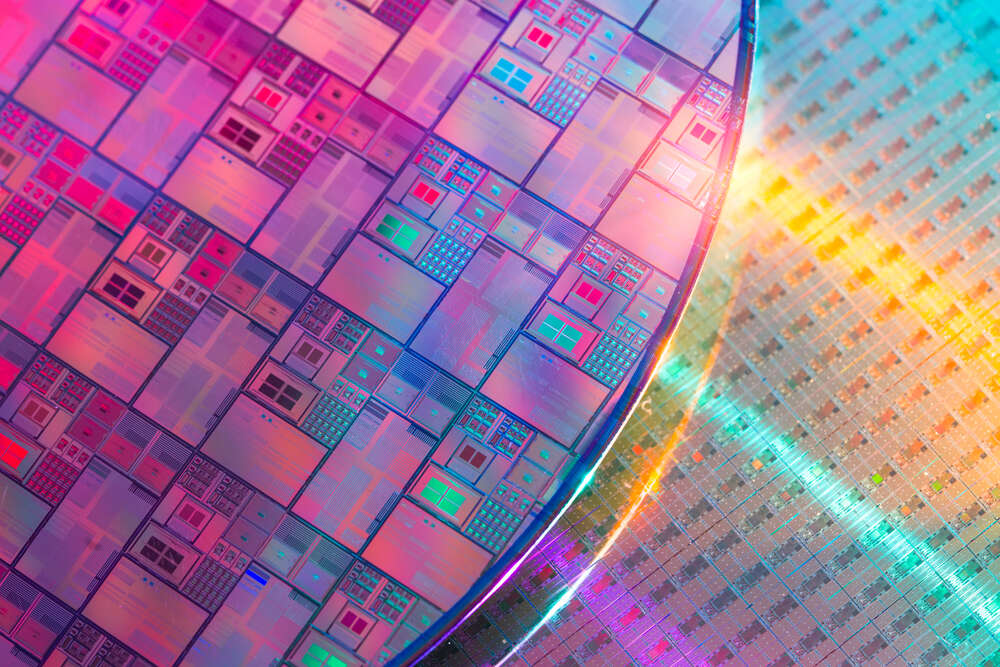

Under the plan, first reported by Reuters, China will invest 1trn Yuan, or some $143bn, in its chip industry over a five-year period with a focus on advanced manufacturing.

Much of the funding will be available for purchases of domestic semiconductor equipment for chip-producing foundries, known as fabs, and companies will be entitled to a subsidy of up to 20% on the cost of equipment, a source with knowledge of the plans told Reuters.

It is thought Chinese companies will also receive tax breaks for investing in the assembly, packaging, and R&D of chips.

The government in Beijing is under pressure to boost its domestic capabilities because the US government has ramped up the China semiconductor trade war in recent months, using export controls to restrict the supply of vital lithography machines and other equipment used in chipmaking, as well as banning US firms such as Nvidia and AMD from selling their advanced processors to Chinese clients.

Whether the investment will help China develop its own advanced chips more quickly is questionable. Without access to leading-edge lithography technology supplied by Dutch company ASML, which is banned from selling its most advanced machines to Chinese clients, domestic chipmakers are unable to match the manufacturing capabilities of the likes of TSMC and Samsung, which are both developing small, efficient chips on a 3nm process node to use in smartphones and servers.

Chinese manufacturers have been investing in older process node technology in recent years, and the country’s biggest chipmaker, SMIC, reportedly built a 7nm chip earlier this year. Though this came as a surprise to many people outside China, it indicates the company is still a distance behind its foreign rivals.

Japan inks deal with IBM as it targets semiconductor sovereignty

China is not the only country looking to boost its domestic semiconductor manufacturing capabilities. Europe is also aspiring to become more self-reliant when it comes to chips, with the European Union having introduced the €43bn European Chips Act earlier this year.

This global push for semiconductor sovereignty was catalysed by the global chip shortage which followed the Covid-19 pandemic and exposed the reliance of many industries on a small pool of manufacturers in South East Asia, led by TSMC and Samsung.

Today Japan became the latest country to take a step forward in its push for chip sovereignty, announcing a partnership with IBM which aims to have advanced chipmaking up and running in Japan by the second half of this decade.

IBM will work with Rapidus, a newly formed chipmaker backed by the Japanese government, to develop a manufacturing process for IBM’s 2nm chip. Big Blue unveiled the breakthrough last year, saying it can potentially offer 45% more processing power and 75% greater energy efficiency than 7nm. It will now work with Rapidus to bring the technology into a real-world setting.

“This is a long-desired international collaboration, truly essential for Japan to once again play a vital role in the semiconductor supply chain,” said Atsuyoshi Koike, president and CEO of Rapidus. “I am fully confident that this collaboration will pave the way for our goal of contributing to the wellbeing of humanity through advanced logic semiconductors produced with technologies jointly developed with IBM.”