Amazon founder Jeff Bezos said that it is up to governments to ensure that the company pays fair taxes and that it will not do so as “an act of kindness”, in a meeting with Boris Johnson this week. Like other tech giants, Amazon has attracted ire over its slim tax contributions, and while a new global tax regime is currently being debated, experts say this won’t increase Amazon’s UK tax burden.

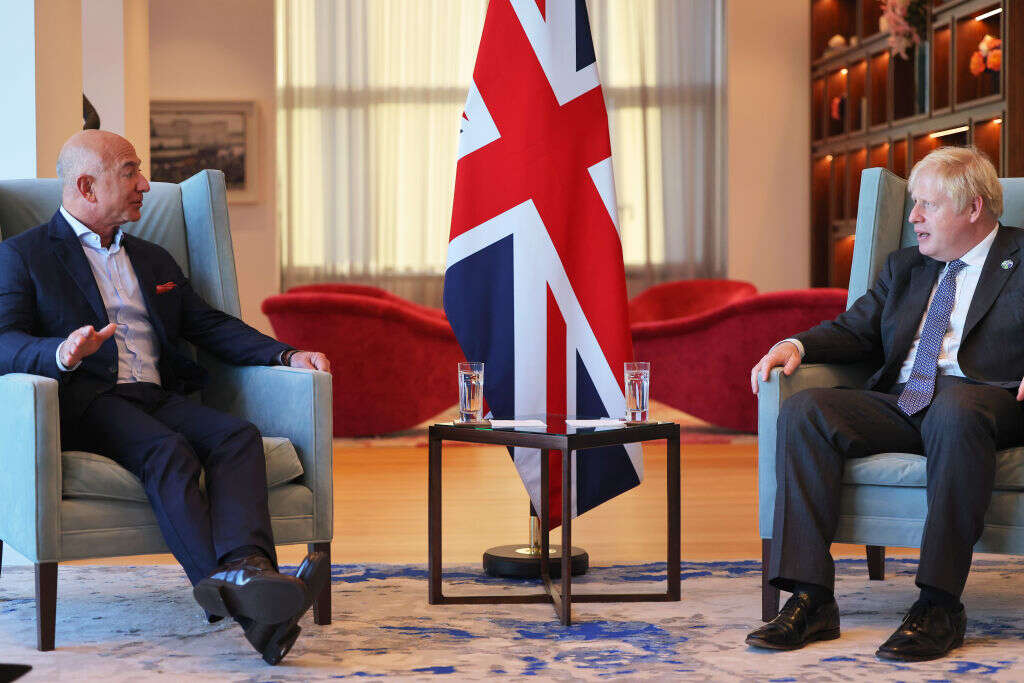

Jeff Bezos and Boris Johnson meet during the Prime Minister’s visit to the US this week. (Photo by Michael M. Santiago/Getty Images)

The UK prime minister raised the issue of taxation with the Amazon founder and executive chairman at a meeting held at the United Nations General Assembly. He received a predictable response. “[Bezos is] a capitalist, and he made the very important point that this is a job for governments,” Johnson told Channel 5 News. “It’s up to governments to come up with the right framework.”

As Amazon’s profits have ballooned, it’s attracted increased scrutiny over its meagre tax contributions. Although the company’s revenues in the UK increased by more than 50% in 2020 to £20.63bn, its key UK division paid only £18.3m in direct taxes.

Will new G7 tax regime hit Amazon in the pocket?

G7 countries agreed on a new tax regime comprising two pillars in June, which was partly motivated by the concern that US tech behemoths don’t pay their fair share.

Pillar One of the agreement would see a portion of the largest multinationals’ global profits distributed among countries where they operate, rather than where they are headquartered. It says that 20% of any profit above a 10% margin would be reallocated and subjected to tax in different jurisdictions. The provision is intended to more evenly distribute the spoils of the globalised digital economy.

Pillar Two sets a global minimum 15% corporate tax rate, aimed at shuttering tax havens that impose no corporation tax. The plans, which are currently being overseen by the OECD, were embraced by G20 finance ministers and now more than 130 countries have signed up.

“Amazon has consistently supported the OECD Inclusive Framework’s effort to achieve a consensus-based solution for international tax harmonisation, and we welcome the continued progress,” a spokesperson told Tech Monitor.

The UK and some other European countries have implemented their own digital taxes as a placeholder before the new international tax regime is in place. The UK’s Digital Services Tax, which levies a 2% tax on revenues above £25m, covers large multinationals providing social media services, search engines or online marketplaces.

The DST was first implemented in April 2020 and the Treasury has predicted it will raise £500m a year by 2024-25. The UK is expected to scrap the DST when Pillar One provisions are finalised.

Why is Amazon so difficult to tax?

Big Tech – comprising Amazon, Facebook, Google, Netflix, Apple and Microsoft – were accused of avoiding $100bn of global tax over the past ten years, in a report by the Fair Tax Foundation. Amazon was named the worst offender, having paid just $3.4bn in tax on its income so far this decade, despite accruing profits of $26.8bn. Amazon disputes this claim and says it pays the correct amount of tax.

One of the ways Amazon minimises its UK tax bill is by officially reporting its British retail sales in low-tax Luxembourg. Analysis by union Unite found that of the company’s £13.7bn in UK sales in 2019, only £5.5bn worth were published in filings for UK-based companies. The rest was routed through its Luxembourg-based subsidiary – which qualifies as ‘loss-making’, and therefore pays no tax.

Amazon looked set to escape the Pillar One provision of the G7 agreement too because the company as a whole has a profit margin of less than 10%. This is because its retail business operated at a 3% margin last year.

As a result, finance ministers are now considering treating Amazon’s cloud computing arm, AWS, separately from its retail business under the new tax plan. The operating income of AWS, the leader in the cloud market, increased by 47% to $13.5bn last year, equating to an operating margin of 30%.

It’s essentially an “Amazon carve-in”, says George Turner, executive director of TaxWatch, provoked by “the embarrassment of the idea that Amazon wouldn’t be covered by the global tax deal, having been the bête noire of the tax world for so long.”

Will Amazon pay more tax in the UK?

The move means that all the US tech giants would be ensnared by the new tax plan. But whether the new tax regime would mean more taxes for countries like the UK is another issue. TaxWatch has said that tech giants could be poised to enjoy a decreased tax burden in the UK under the new regime. Amazon, eBay, Facebook and Google would pay £232.5m less in tax under the G7 plans based on their 2019 revenues, an analysis by the think tank found.

The country set to win biggest from the new tax agreement will be the US, because US multinationals that shift profits to low tax countries to avoid domestic corporate taxes would be forced to pay more in the US.

I think that if the UK had its way, it wouldn’t have even agreed to the G20 deal.

Paul Monaghan, Fair Tax Foundation

Despite Johnson’s ostensible concerns over Amazon’s taxes, many are sceptical that the government is serious about raising more tax from multinationals. “I think that if the UK had its way, it wouldn’t have even agreed to the G20 deal,” says Paul Monaghan, chief executive of the Fair Tax Foundation.

“There has been a significant backlash within the Conservative Party about the signing of this deal, because there are still [politicians] who believe in the Singapore-on-the-Thames approach, and they think that agreeing to a global minimum tax rate will limit the UK ability to become a tax haven off the coast of Europe.”

The UK was slow to embrace the new G7 proposals, and has attracted criticism for saying that the financial sector should be exempt from the new regime. As a result, some have speculated that Johnson raised the tax issue with Bezos purely to signal his credentials to Biden, who is a strong advocate of the new plans.

“If Boris Johnson thinks that Amazon are not paying enough tax then he either needs to change the law or enforce the law,” says Turner. “The tax system is not voluntary. Going to the US cap in hand is a pointless PR stunt, and not one that makes us look very good either.”