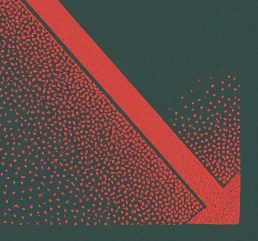

The number of startup failures in the US surged by 58% in the first quarter of 2024, it has emerged. According to Carta, a global platform that provides equity management and valuation services to private companies, 254 venture-backed companies went out of business during the aforesaid period. This represents the highest quarterly total recorded this decade and highlights a significant ongoing trend in the startup sector.

Over the past two years, the rate of startup shutdowns has escalated sharply. From Q1 2022 to Q1 2023, closures increased by 124%, and from Q1 2023 to Q1 2024, the count rose by an additional 58%.

Carta’s data includes startups that have closed their accounts on the platform due to business failure. It is important to note that some companies may leave Carta without specifying a reason, which suggests that the actual number of shutdowns could be higher.

Additionally, while the increase in reported closures is partly due to a growing number of companies using Carta, the rate of shutdowns has outpaced this growth, indicating a severe deterioration in the startup landscape.

Fundraising drought for startups

The recent rise in startup failures is largely attributed by Carta to shifts in the fundraising environment. During the technology boom of 2021-22, with interest rates kept at historic lows, many startups secured substantial investment. However, there has been a dramatic decline in venture capital allocations since then amid worldwide inflation and supply chain disruption, the result being a notable drop in deal activity.

For instance, Q4 2023 saw over 1,000 fewer venture fundings compared to Q4 2021. This disparity between the demand for new funding and the available capital has left many startups struggling to survive.

Sach Chitnis, co-founder and partner at Jump Capital, identified two primary categories of startups experiencing closures in a Carta blog post last month. The first group includes younger companies that raised initial funding during the market boom but have struggled to adapt as market conditions shifted.

“There are a fair number of 2020 and 2021 vintage deals that just never really got liftoff,” wrote Chitnis. “The business is subscale, where they can never get it to a point that it’s an interesting business from a venture perspective.”

The second group consists of more mature startups that thrived under different economic conditions. These companies, which focused on rapid growth during the earlier boom, now face challenges as investors prioritise profitability and early revenue.

“You’re also seeing companies that had unit economics that were completely underwater,” said Chitnis. “You saw a lot of this in fintech, insurtech, and other areas where customer acquisition was at all costs. That is going to have ramifications.”

Shutdowns, too, are increasingly prevalent across various venture stages. From Q1 2023 to Q1 2024, closures have risen by 102% at the seed stage, 61% at Series A, and 133% at Series B.

Despite these challenges, some startups have successfully adapted to the evolving fundraising environment.

Chitnis said: “Anyone who was receptive to those conversations took action. I don’t know the exact percentage in our portfolio, but we have a fair number of companies that have gotten to breakeven and are now reinvesting into growth.”

Among the startups that shut down in Q1, 136 had previously raised at least one priced round of funding, while 118 had not. This marks the first time in five quarters that shutdowns have been more common among companies with prior priced funding rounds.

String of shutdowns

Among the most significant failures in the US tech startup ecosystem this year were Tally, Mindstrong, Tessera, and Rad Power Bikes.

Tally, a San Francisco-based fintech company that specialised in helping consumers manage and pay off their credit card debt. Despite raising $172m since its founding, Tally was unable to secure further funding to continue its operations.

Mindstrong, a mental health tech startup, aimed to revolutionise the field with its digital health platform. Despite raising over $160m and achieving unicorn status, the company faced insurmountable challenges due to economic pressures and a tough fundraising environment. Mindstrong ceased operations in March, selling its technology assets to another mental health company, SonderMind.

Rad Power Bikes, primarily known for its electric bikes, also had significant tech elements in its operations, including e-commerce platforms and fleet management software. Despite its earlier success and raising over $300m, the company was unable to navigate operational and market challenges. After multiple layoffs and restructuring efforts, Rad Power Bikes closed down this year.