Slack IPO filing reveals extent of losses, scale of growth, listing plans:

- Direct listing planned under “SK” ticker symbol

- 88,000 paying customers

- Net loss of $139 million in 2019

- Company sees “$28 billion” market opportunity

- Paying customer growth is slowing

One of 2019’s most keenly anticipated public listings has lift-off: Slack filed its paperwork with the US’s Securities and Exchange Commission (SEC) today and it reveals that the company now has 88,000 paying customers; a figure vastly outnumbered by the 500,000 organisations still on its free subscription plan.

The workspace collaboration software company plans to list on the New York Stock Exchange (NYSE) under an “SK” ticker symbol and is doing so, as previously reported, via a direct listing — this allows the company’s shareholders, such as early investors or employees, to begin selling their stock on the exchange with public investors buying stock directly from these insiders, rather than investment bank middlemen.

In an exceptionally bullish assessment of the market opportunity, Slack’s team said: “We believe everyone whose working life is mediated by email is a potential Slack user… we further believe that the shift to Slack, or services like Slack, is inevitable.”

“We estimate the market opportunity for Slack and other providers of workplace business technology software platforms for communication and collaboration to be $28 billion.”

The assessment comes despite the company’s paying customer growth slowing.

Read this: “A Bumper Year”: UK Tech Exits Topped $40 Billion in 2018, as EU Catches US

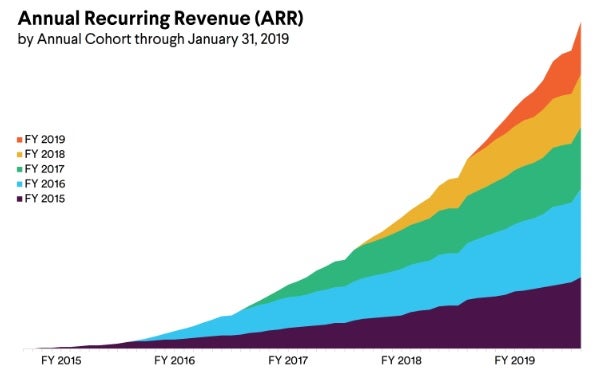

While revenue growth has been strong, the company continues to hemorrhage cash: the saw sales of $105.2 million, $220.5 million, and $400.6 million in fiscal years 2017, 2018, and 2019, respectively, representing annual growth of 110 percent and 82 percent year-on-year. Net losses were $146.9 million, $140.1 million, and $138.9 million.

“Our net losses have been decreasing as a percentage of revenue over time as revenue growth has outpaced the growth in operating expenses” the filing says.

The company notes the market and software categories that it is competing in are competitive, pointing to Microsoft, Google and “consumer application companies who have entered the business software market, such as Facebook” as key competitors.

![]()

“We expect competition to intensify in the future. Established companies may not only develop their own communication and collaboration solutions, platforms for software integration, and secure repositories of information and data, but also acquire or establish product integration, distribution, or other cooperative relationships with our current competitors.”

“For example, while we currently partner with Atlassian Corporation PLC, Google Inc., Okta, Inc., Oracle Corporation, ServiceNow, Inc., salesforce.com, inc., SAP SE, Workday, Inc., and Zoom Video Communications, Inc., among others, they may develop and introduce products that directly or indirectly compete with Slack. New competitors or alliances among competitors may emerge and rapidly acquire significant market share…”

“In addition, some of our larger competitors have substantially broader product offering” the SEC filing notes.

Slack’s official valuation stands at $7.1 billion after an August funding round.

Privacy Shield Risks

Also noteworthy in the filing is the extent to which concerns about trans-Atlantic data transfer remain a regulatory risk.

“In relation to transfers of Personal Data out of the European Economic Area, or the EEA, and Switzerland to the United States, we are currently registered for both the E.U.-U.S. and the Swiss-U.S. Privacy Shield programs” Slack notes.

“There are concerns about the future of Privacy Shield as a data transfer mechanism as it continues to be subject to legal challenges, which, if successful, would require us to ensure that we had alternative data transfer mechanisms.”

“In the interim, if we are investigated by a European data protection authority or the U.S. Federal Trade Commission, or the FTC, and found to have failed to comply with the Privacy Shield programs, we may face fines and other penalties.”

” We also use model contractual clauses (or standard contractual clauses) to transfer, and to enable organizations on Slack to transfer, personal data out of Europe. The validity of model clauses is also the subject of litigation. If the E.U.-U.S. Privacy Shield program or the European Commission decisions underpinning the model contractual clauses are invalidated, we will be required to identify and implement other methods to enable compliant data transfers from the EEA and Switzerland to the United States. Such methods may be more costly or not available to us.”