Quantum computing in finance owes a lot to your average Bronze Age merchant. Derivatives – types of contract wherein an asset’s value is derived from the performance of an underlying factor – originated in ancient Mesopotamia, where they were used by local kings to govern their payments for grain in case of drought, and by merchants to finance long-distance trade. ‘Six shekels silver as a šu-lá loan,’ reads one tablet. ‘In the sixth month he will repay it with sesame according to the going rate.’

Calculating the price of derivatives today is a shade more complicated. Computing the price of, say, stock options usually sees banks lean on the Monte Carlo method of statistical analysis. Named after the spendthrift habits of its inventor’s uncle, the approach takes all the inputs available to predict an uncertain outcome, plus a series of random ones, and simulates that scenario, over and over, to compute an average. As a result, Monte Carlo simulations provide a reasonable approximation of a future outcome – a useful tool for a trading desk looking to make a cool billion on sesame futures.

The complexity of these models, however, is constrained by the processing power of the classical computers running them. That’s where quantum computers come in. By the early 2000s, researchers began demonstrating that the use of quantum algorithms in Monte Carlo simulations could lead to a quadratic speed-up in reaching a prediction, thereby creating new opportunities for ever more complicated models stretching further into the future.

It’s just one example of the type of niche, incredibly complicated problem that quantum computers could help to solve for banks the world over. “In finance, we have many use cases [that] have exponential complexity,” explained Marco Pistoia, managing director of JPMorgan Chase’s Global Technology Applied Research Center, during a financial conference in October. “[That] level of complexity explodes as soon as a dataset becomes big enough, and a classical computer cannot solve that problem anymore.”

The computational speed-up offered by quantum computers, by contrast, can be applied to a multitude of optimisation problems, as well as train new machine learning algorithms to summarise complex documents at scale and spot suspicious transactions. It’s this potential that has led a series of major financial institutions to invest in quantum research teams – and tech giants such as Google and IBM to grant them access to their increasingly sophisticated quantum machines.

“It’s not like a hobby,” says Stefan Woerner, manager of quantum applications research and software at IBM Quantum. Much of Woerner’s day is now spent liaising with teams in banks about how best to apply the raw computing power of IBM quantum processors to new and exotic mathematical challenges. “I’m definitely biased here,” he says, but “there are more banks doing this serious effort in quantum than…in any other industry”.

These efforts are leading an increasing number of industry observers to think that the financial sector will spearhead the first widespread practical usage of quantum computers. But as the big banks chomp at the bit to obtain an edge in the most niche, unfathomably complex mathematical problems, questions remain as to the viability of the hardware being used – and how jealously major financial institutions will guard their newfound quantum advantage.

Use cases galore for quantum computers in finance

The engineers at IBM Research’s facility in Zurich breathe rarefied air. Situated atop a hill overlooking the city’s eponymous lake, visitors can glimpse the complex by means of a circuitous route from Thalwill’s train station. The sights along the path unfold like a crude metaphor about socioeconomics, winding upward from the shabby pharmacies and cosmetic boutiques near the bahnhof to the ultramodern villas boasting underground, Porsche-laded garages built into the hillside, until finally the visitor glimpses the squat, whitewashed walls of the IBM compound.

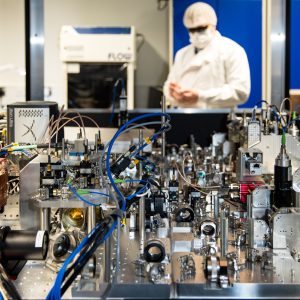

While whoever built the IBM Research complex seemed unencumbered by thoughts of wealth or aesthetics, inside Tech Monitor toured a facility brimming with tape drives, lasers and a humming, torpedo tube of a quantum computer – which, the presiding engineer clarifies, is only used to run minor experiments. There’s a fleet of intimidatingly larger ones in the US designed to take on the majority of the commercial work for IBM’s quantum computing division, he says, which, as Woerner later explains, has begun in earnest for banks.

“I think the financial services sector is definitely an early adopter,” says Woerner, who claims to spend much of his time collaborating with research teams at a variety of major banking institutions. It has effectively turned the IBM facility in Zurich into a kind of forward operating base directing its work with big banks, which has seen the firm collaborate with Barclays, HSBC, Goldman Sachs and JPMorgan Chase at various points over the past five years. Recent years have seen these collaborations move from the purely experimental to a greyer area, where commercial applications seem just around the corner.

One lies in devising more efficient machine learning algorithms, starting with those tasked with natural language processing. In December, for example, JPMorgan Chase successfully demonstrated how a 20-qubit quantum computer could be used to summarise reams of documents using natural language processing (NLP.) “Every morning [traders] have to read a lot of documents in order to make the best-informed decisions about investments,” Pistoia tells Tech Monitor in front of a whiteboard packed with equations in blue and red marker pen. “And also our legal departments: sometimes, they have to read entire books-worth of documents.”

While the researcher isn’t suggesting banks should let a quantum-powered AI loose on all documents requiring legal oversight, Pistoia maintains it probably would be helpful to create new software that highlights key points or red flags in these dense texts. Fraud detection is another lucrative application area, with HSBC partnering with IBM to investigate this problem in March 2022. While neural networks are already adept at sifting through the vast majority of transactions for criminal activity, they’re still stumped every once in a while by individual money transfers they suspect are fraudulent but cannot tell why. It’s in the assessment of these transactions, explains Woerner, where “we might use the quantum computer as a second opinion”.

Perhaps the most exciting use cases, as far as a bank’s bottom line is concerned, lie in optimisation and risk analysis. In the case of the former, quantum computers are much more efficient at parsing these problems than their classical antecedents, not least in tasks like portfolio optimisation. Experiments in this area are ongoing: JPMC, for example, has demonstrated the feasibility of running its NISQ-HHL quantum algorithm to solve what Pistoia has described elsewhere as a “very small portfolio optimisation problem,” while Caixa Bank has collaborated with D-Wave Systems in using the latter’s machines to conduct investment portfolio hedging.

The holy grail of financial quantum computers, however, lies in using them to expedite Monte Carlo simulations, a use case being actively explored by Goldman Sachs, HSBC and Ally Financial. The former has been especially active in exploring how quantum computers could be used to price complex derivatives, like stock options, partnering first with IBM and then Microsoft to delve further into the problem.

‘Derivatives are so common in finance that even a small improvement in pricing them, or in calculating related quantities, could be very valuable,’ wrote Dr Will Zeng, Goldman Sach’s head of quantum research, in a September blog post. The bank’s latest experiments saw it not only improve the accuracy of its resource estimates for quantum advantage in derivative pricing, but also gave it ‘a foundation to more rapidly iterate on updated versions and on other algorithms that use similar subroutines’.

Hardware problems

How long before banks will be able to actually use quantum computers on a daily basis, though, remains unclear, thanks in large part to the limitations of the hardware that’s available. As such, none of the applications described above are ready for practical use. The fact remains that even the most advanced quantum computers are still incredibly noisy, and while significant advances have been made in recent years in the field of error correction, a high percentage of qubits are still being reserved for this purpose – a situation that likely won’t change until researchers manage to build quantum computers with thousands of usable qubits.

That doesn’t leave a lot of room for computational wizardry in the meantime, leaving the field in the strange situation where the use cases are being mapped out in increasing detail but waiting for the hardware to catch up and permit practical demonstrations. Consequently, explains Dr Daniel Fasnacht, a lecturer in finance executive education at the University of Zurich, it’s still hard to find practical demonstrations in the wild. “The tech companies, they don’t tell you what they do,” he says. “Banks, they announce their partnerships or alliances with tech companies, and that’s it.”

There are grounds for optimism, with tech giants such as Intel, Google and IBM announcing key milestones in their roadmaps to increase the number of usable qubits in their respective quantum computing architectures. Pistoia, for his part, remains optimistic that banks will begin turning theory into practice sooner rather than later. “If I see where we were…in 2016, for example, and compare it to where we are now in 2023, I think we are way ahead of where we expected we would be,” he says.

It’s fair to say, though, that quantum computing has yet to even appear on the radar for any but the largest financial institutions. For his part, Fasnacht earnestly believes in the transformative potential of quantum computing for the financial sector. Even so, his attempts to argue this point to executives from many other global banks have often been met with blank stares. “They have no clue about what’s coming, they’re so busy with other issues,” he says. “They just know the term ‘quantum computing,’ and that’s it.”

That’s likely to remain the case even in the early days of quantum advantage for financial institutions. It’s hard enough even for institutions like JPMorgan Chase, explains Pistoia, to recruit the talent capable of writing the code necessary to run on the latest machines. “It’s so different from anything else that we have ever done before,” he says, requiring skills, software stacks and computing equipment rarely seen inside commercial banking institutions.

For its part, says Sathish Muthukrishnan, Ally Financial has adopted a hybrid approach, recruiting its own team of quantum physicists while creating new partnerships with academia and with the growing number of quantum start-ups. It’s also cultivated a relationship with Big Tech firms, explains its chief information, data and digital officer, not least with Microsoft, which is keen to hone its own understanding of relevant use cases for quantum computers in finance. “We partnered with Microsoft Quantum Labs early on, giving them the real use cases we’ll be working on, the type of data that they should be working on, while leveraging the hardware that they’re building,” says Muthukrishnan.

However, it’s unlikely that the use or abuse of quantum computers will remain the preserve of the financial sector for long. Last year, EY found that up to 81% of senior UK executives it surveyed predicted quantum computing would be changing their respective industries by the end of the decade, although few actually had any concrete plans to prepare for this eventuality. Even so, some of the general computational problems financial institutions are experimenting with using quantum computers to solve are also being played out by firms in other sectors. Eon, for example, is already working with IBM directly to run simulations of future energy price fluctuations on its quantum processors.

“I can also think of some scheduling problems, some logistics problems,” says Woerner, which quantum computers can help to solve across a wide range of industries. “All of these are combinatorial optimisation problems. And…if you reach the right scale where classical starts to struggle, well, then quantum really does help.”

Though quantum computing remains in its infancy, Fasnacht believes that its practical impact will quickly be felt across the financial sector. A great believer in Schumpeter’s theory of economic cycles being triggered by base technologies, the Swiss professor explains that he’s already lived through the so-called fifth Kondrattief wave triggered by the invention of the silicon chip. Now, says Fasnacht, “I teach that the quantum computer could be the logical next base technology.”