An “arms race” to provide data centre capacity to hyperscale cloud providers is continuing, with companies like AWS and Azure procuring a whopping 100MW (megawatts) of co-location data centre capacity in Frankfurt, London, Amsterdam and Paris alone in the past 12 months alone, according to consultancy CBRE.

Hyperscale cloud providers now account for an astonishing 81 percent of all capacity booked in co-location data centres across Europe, CBRE said.

During the first quarter of 2019 that momentum showed no signs of slowing, with 41MW of data centre capacity procured by the hyperscalers; over 50 percent of that in Frankfurt alone, CBRE said this week. Paris had a second consecutive quarter of over 10MW of take-up, the first time it has ever managed that feat.

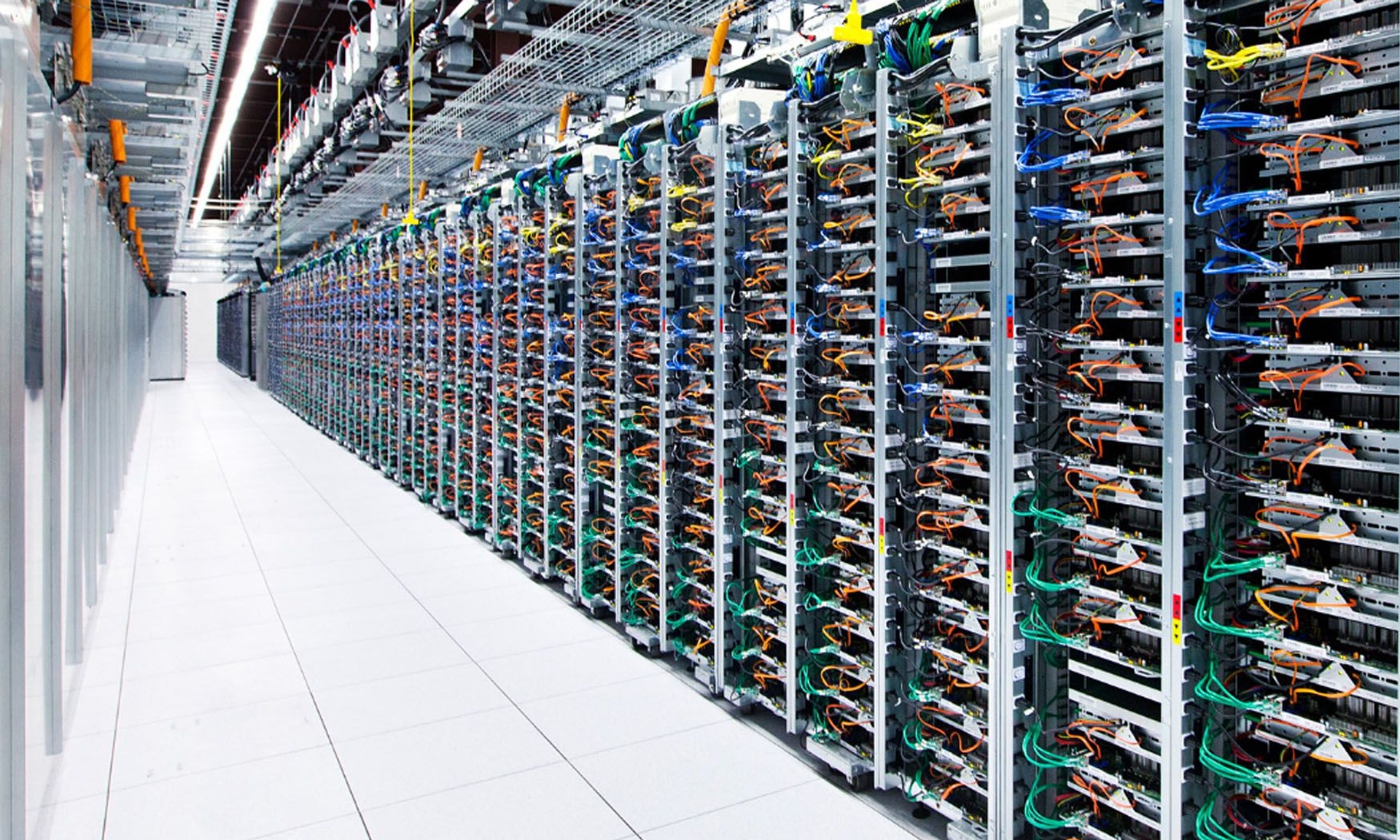

(Co-location providers take the capex and investment risk, building out the infrastructure at scale – e.g. security, power, cooling – then leasing racks of servers to clients ranging from cloud providers to enterprise or government customers).

See also: This Old Brewery Hides Three Data Centres, 90 ISP Connections and 14 Generators

London slowed, but Mitul Patel, Head of EMEA Data Centre Research at CBRE, told Computer Business Review that this was little indication of any long-term structural disinterest in the UK as a market. He said: “Cloud companies now account for 81 percent of all up-take. If they focus on one particular city for a quarter, everywhere else can go a bit quiet and developers need to be prepared for that.”

He added: “London still accounts for 40 percent of the market overall and is where a lot of the action is. It’s simply that as enterprises move to the cloud, rather than them booking colocation capacity, the cloud providers can bundle that capacity into a handful of large contracts. These are getting larger and more frequent.”

CBRE forecasts that market growth will be sustained throughout this year, with a further 223MW of additional supply brought online by the end of 2019, as European and US data centre developer-operators aggressively grow their footprint in order to compete for this limited number of increasingly large cloud colocation contracts.

Read this: 5 Things We Learned from Google’s 2018 Results

Mitul Patel, Head of EMEA Data Centre Research at CBRE commented: “The major themes driving the European data centre sector, larger customer requirements, bigger data centre developments and heightened levels of M&A, all continue to be driven off the back of what the cloud providers are doing.”

He added: “Companies right across the supply chain are redefining whole business models to serve this one client-base.”

An example of the sort of capex being deployed: Google’s capital expenditure alone in 2018 was $25.46 billion, a figure spent mostly on data centres and offices, its Q1 earnings revealed. CBRE’s report is a backed up by conversations Computer Business Review has had with those in the market.

As the EMEA managing director of US colocation giant Cyrus One told us late last year: “It’s a race to scale. The cloud has to go somewhere physically. Easier for cloud to go into third party co-location business. It’s hard for them to forecast demand accurately, so it’s easier for them to go into environments in which they can scale.”

Cyrus One’s Matt Pullen added: “The market can’t build this stuff quick enough. But cloud won’t commit unless they can see capacity to that kind of scale growth. They don’t want fragmented data centres. They want to put network rows in then scale within a single facility. We’re committing to a further 36MW in London.”

Read this: Exclusive: CyrusOne to Build THREE New London Data Centres

*Data centers are hugely energy-intensive and the importance of power supply to them means that MW is typically used instead of square feet as a proxy for overall capacity/the benchmark for scale.