In the competitive world of finance, institutions are looking increasingly at ICT as a catalyst to revolutionise their operations.

This change is being forced by a combination of regulatory restrictions and high expenditure in maintaining legacy systems.

Research from Kable Global ICT found that financial market institutions have been increasing their investment in software in 2015; this is so that they can improve core operations like accounting, ordering and billing.

Communications and collaborations solutions are also seeing an increase in investment, while private cloud along with infrastructure as a service are being implemented to both reduce operational costs and to create agility.

Investment in ICT budgets is expected to increase from 33% in 2014 to 58% in 2015, while the proportion of institutions anticipating a decline in ICT budgets is expected to go down from 25% in 2014 to 16% in 2015.

This shows that financial institutions will have more money to spend on technology that advances them, which could potentially be profitable for ICT vendors.

The allocation of software budgets has seen 25% allocated to software licenses, with this going towards products such as customer relationship management and business process management, which are designed to help support and improve business operations.

The follow on from this is that 23% of software budgets are being spent on support costs and maintenance.

Given the complex regulatory nature that financial institutions operate in, many applications are customised to fit their needs.

This has resulted in 24% of their IT services budget being spent on application development and integration.

Tied in with the regulatory factor and the desired expansion into private cloud use, is an increased expenditure on security and privacy services.

Institutions are allocating 18% of their average services budget into this area, in order to protect mission-critical data and assets.

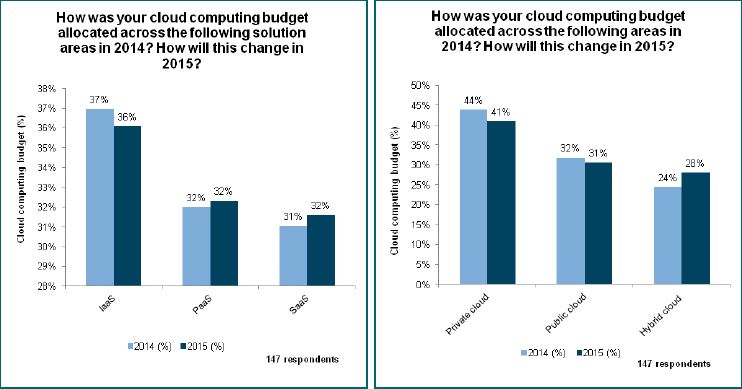

Of cloud computing services, IaaS remains the most popular (36%), while PaaS and SaaS level at 32%.

The typical deployment method is through a private cloud model (41%), however, this has decreased from 44% in 2014. Hybrid cloud has grown in popularity from 24% in 2014, to 28% in 2015.

This signifies an increased demand for the benefits of public cloud computing for cost effective customer transactions, combined with private cloud for core financial applications that meet security and compliance standards.

Hybrid cloud is expected to gain further traction in the sector with 65% of respondents saying they are keen to spend in this area.

All figures come from Kable’s ICT Customer Insight survey, which surveyed 147 financial institutions 8% of which employ over 10,000 people. Subscribe to Kable here.