“Deepening Huawei Curbs Send Asian Chipmakers Plunging” reads one Bloomberg headline this morning. Not so for China’s VeriSilicon, which successfully floated on Shanghai’s “STAR” exchange today — nearly quadrupling its market cap within minutes, in a sign of the appetite Chinese investors have for home-grown silicon capabilities.

Its IPO comes just one day after Trump further tightened restrictions on Huawei and its suppliers. Some 38 new Huawei affiliates across 21 countries were added to the restricted Entity List because they “present a significant risk of acting on Huawei’s behalf contrary to the national security or foreign policy interests of the United States” the Commerce Department said on Monday, with Trump adding to Fox New: “We don’t want their [Huawei’s] equipment in the United States because they spy on us.”

VeriSilicon, which has been backed by Chinese electronics behemoth Xiaomi Corporation, as well as Intel Capital, and Samsung Investment Corporation, priced its IPO at RMB38.53 (£4.23) per share. The offering raised approximately RMB1.86 billion, giving the company a total market value of RMB$18.6 billion (just under $3 billion).

Within minutes of trading on Shanghai’s Star exchange, shares nearly quadrupled to 150 RMB, VeriSilicon said today. (The company launched its subscription exercise on August 7. As Deal Street reports, shares were oversubscribed a massive 4,335 times).

VeriSilicon’s customers include Broadcom, Samsung, and NXP. It offers ASIC design services, its own Vivante Graphics Processor Unit (GPU) and runs what it describes as a “Silicon Platform as a Service” (SiPaaS) business model — from definition to test and package for “IDM, Fabless, system vendors (OEM/ODM) and large Internet companies”.

(It has five types of in-house processor IP: GPU, NPU, VPU, DSP and ISP, and intellectual property to some 1,400 analog and mixed signal designs.)

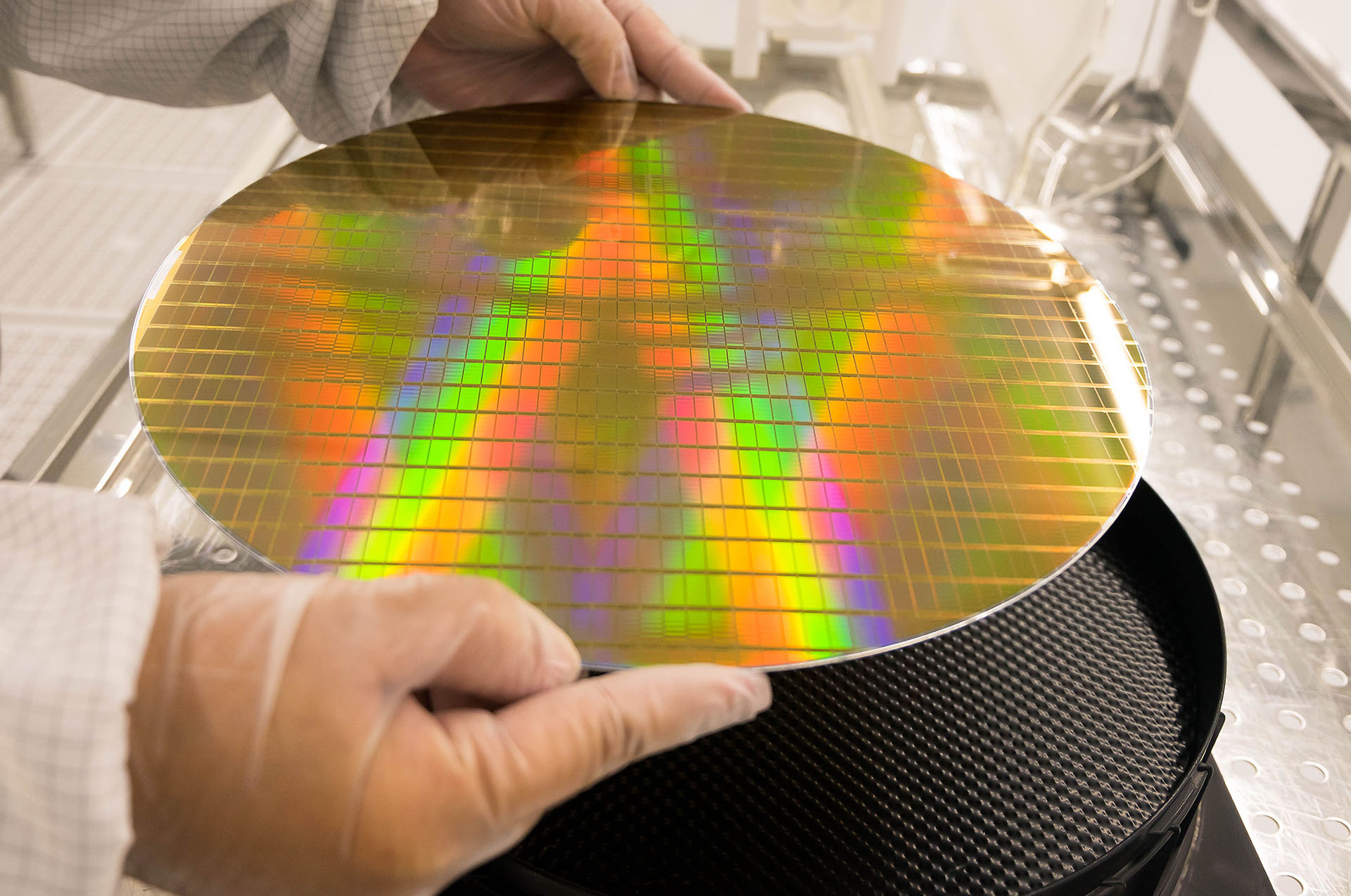

According to IPnest statistics, VeriSilicon ranked first in mainland China and seventh worldwide for IP license revenue in 2019 and claims to have “many successful IC (integrated circuit) design and tapeout experiences at advanced process nodes including 14nm/10nm/7nm FinFET and 28nm/22nm FD-SOI, and has begun the research and development at 5nm FinFET as well as new generation FD-SOI process” it said today.

Founded in 2001 and headquartered in Shanghai, China, VeriSilicon has five design and R&D centers in China and the United States. Business outside China accounted for roughly half of revenues in 2019. Funds raised from the IPO will focus on R&D, including including for consumers devices, as well as a “custom SoC platform for smart cloud” and “R&D center upgrading projects” the company said.

See also: TSMC’s $12 Billion US Chip Plant will “Bolster US National Security”