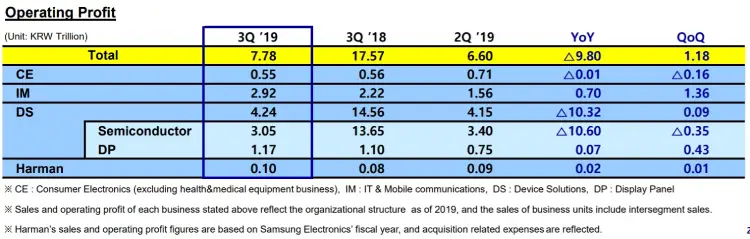

Samsung’s semiconductor profits plunged more than four-fold in Q3 year-on-year, tumbling from 13.65 trillion KRW (£11 billion) to 3.05 trillion KRW (£2 billion), the South Korean firm reported Thursday, as the industry remains hit by stagnant demand, growing competition, and low prices.

The company particularly blamed “large price declines for mobile application processors” amid “intensified competition” on an earnings call.

The US-China trade dispute, smartphone market saturation, a slump in memory prices and slower growth in servers and PCs through 2019 are expected by Gartner to drive the global semiconductor market to its lowest growth since 2009, the research firm said this summer.

Despite the dire looking numbers in the slide, Samsung painted a rosy picture in notes accompanying them, saying it expected memory chip demand to return in Q4 and sustain that higher demand in 2020.

Semiconductor demand actually grew during Q3, it said, as customers added inventory during high season; DRAM shipments rose to address rising demand, mainly from mobile and server applications; NAND sales to data centres expanded for high-density SSDs over 2TB; and foundry demand increased for EUV 7-nano APs and HPCs, computing, and 5G network chips.

SeWon Chun, executive VP of the company’s semiconductor business said: “Customers became increasingly aware of a price bottom, which led to better than expected demand growth. We saw increasing SSD adoption in PCs, and high demand for SSDs from data centres.”

The company’s foundry business is expected to start “full-fledged mass production of 7-nano chips and orders of HPC, AI, and network chips rise” in Q4, it projected, with memory demand to “edge up” quarter-on-quarter as clients continue to secure inventory.

Samsung said it plans to increase CIS [image sensors that allow an electronic device to convert an optical image into an electronic signal] capacity in Q1 2020, and expect inventory to normalise in the first half of 2020.