A profit warning by online retailer ASOS this morning has sent shares plunging 35 percent. The company blamed “economic uncertainty” and weak confidence, along with seasonal factors for a slump in sales. Traders dumping shares in the London-based company cut over £1 billion from its market capitalisation in hours.

ASOS has been expanding at a blistering pace on strong sales, even as bricks-and-mortar retailers struggle, and in the UK seen sales growth year-to-date of over 19 percent – “although this has been achieved at the cost of more promotional activity than initially planned and consumers buying into lower priced product,” ASOS said.

For Struggling Retailers, can AI Save the Day?

ASOS’s case may be extreme, but retail confidence across the board is weak. With discounts already high, there may be little that retailers can do to restore “animal spirits” among consumers in a challenging environment.

See also: Retail Intelligence Company Trax Raises $125 Million, Brings Cameras to Supermarket Shelves

Researchers at consultancy Capgemini this morning however, said one route to improved growth was clear: wider deployment of AI.

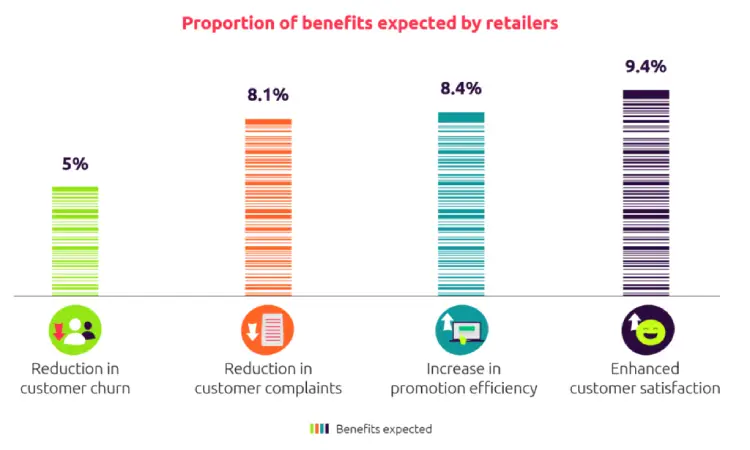

Capgemini calculates a $300 billion+ opportunity for those retail companies that are able to scale and expand the scope of their existing deployments and in a substantial new study found that the UK was a leader in AI adoption by the retail sector).

AI Retail Superstars?

In a report “Retail superstars: How unleashing AI across functions offers a multi-billion dollar opportunity”, the consultancy looked at 400 global retailers that are implementing AI use cases at different stages of maturity – a group that represents 23 percent of the global retail market by revenue. The study further included an extensive analysis of public data from the world’s largest 250 retailers, by revenue.

As Tom Pinckney, VP of Applied Research at eBay, puts it: “AI and ML are driving incremental sales that wouldn’t otherwise have happened.”

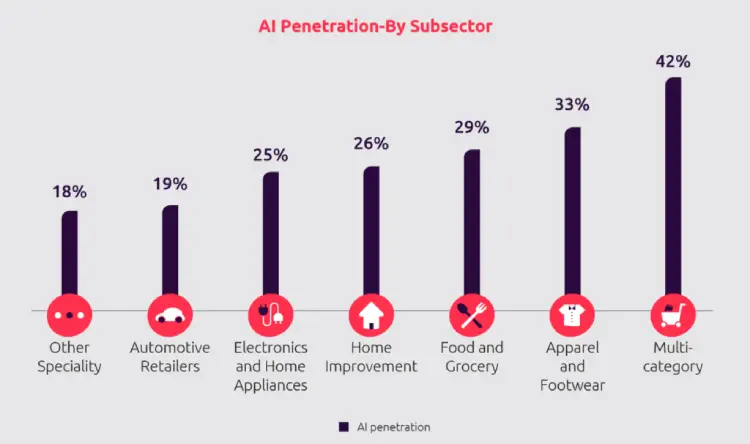

AI Retail Penetration

The study, “Retail superstars: How unleashing AI across functions offers a multi-billion dollar opportunity”, looked at 400 global retailers that are implementing AI use cases at different stages of maturity – a group that represents 23% of the global retail market by revenue. The study further included an extensive analysis of public data from the world’s largest 250 retailers, by revenue.

Read this: Microsoft Develops “Image Segmentation Tool” Using Deep Learning – Targets Retail Industry

“There are notable examples of large players making significant moves. For example, Tesco is incorporating machine-learning algorithms across its business, from customer-facing functions to operational departments – and setting up the groundwork for centralized data models to overlay their AI initiatives. Walmart is investing significantly in high-level graphical processing units (GPUs) to power AI algorithms”.

Capgemini added: “In the UK, online supermarket Ocado – one of the world’s largest online-only retailers – has been an aggressive adopter of artificial intelligence technologies. The company, in addition to selling groceries, also licenses its automation technology and equipment. At its warehouses in the UK, thousands of robots help pick groceries out of storage and fulfill as many as 65,000 orders every week”

AI is used in apparel and footwear primarily to personalise customer engagement and product search and the consultancy says the focus on consumer-facing initiatives means a major opportunity is being missed in operations.

Capgemini emphasises AI for assortment rationalisation, pricing decisions, advanced demand planning, predictive logistics network management, visual inspection of warehouse assets and category optimisation are among the myriad areas in which AI has yet to make substantial inroads.

Putting AI to use across procurement, supply chain, logistics, returns and in-store “pilferage” could generate $340 billion in cost savings across the industry by 2022, the report concludes.