President Muhammadu Buhari of Nigeria stared for a few moments at the framed poster proudly emblazoned with the symbol of his country’s new digital currency. The eNaira, according to the Central Bank of Nigeria (CBN), would allow Africa’s most populous nation to experience the full benefits of the global digital economy. As he held the poster for the benefit of the national press at the back of the room, however, the gravity of the moment seemed to pass Buhari by. “So, what do we do?” he asked his central bank governor, gesturing toward the symbol. “That is it?”

These comments were at odds with those delivered in his subsequent speech. “This payment system now provides high-value and time-critical payment services to financial institutions, and ultimately serves as the backbone for every electronic payment in Nigeria,” said Buhari, reading haltingly from a script.

Pegged at a one-to-one exchange rate with the Naira, the new central bank digital currency (CBDC) would ultimately reduce the influence of informal, cash-based economy in Nigeria and significantly expand the country’s tax base. The result, said Buhari, would be a brighter economic future for the nation – to the tune of an estimated $29bn rise in GDP over the next decade.

The rollout of the eNaira last October wasn’t just momentous for the Nigerian economy. While 87 nations are currently investigating how to implement their own CBDCs, only two others have actually been officially launched: DCash in the Eastern Caribbean, and the Sand Dollar in the Bahamas. Designed to accommodate the needs of over 200 million citizens, however, the eNaira is by far the largest active CBDC project in the world. In a national economy that has been hit especially hard by the pandemic, the new digital currency is designed to give the CBN new and valuable insights into how and when money is spent, as well as disburse financial aid more quickly to those in need.

As such, “the eNaira has largely been welcomed by Nigerians,” explains Professor Iwa Salami of the University of East London, especially given its potential to lower remittance transfer costs. “At the same time, there are indications of scepticism among the more technologically savvy.”

The eNaira has largely been welcomed by Nigerians [but] there are indications of scepticism among the more technologically savvy.

Professor Iwa Salami, University of East London

Almost as soon as it was launched, users complained of poor functionality and the app was briefly withdrawn from the Google Play Store for improvements. By January, only 694,000 eNaira wallets had been downloaded (the e-Yuan, by contrast, remains in its pilot stage but boasts some 260 million users). Spending also remained low, with $450,000 worth of transactions recorded.

Doubtless this has been down to the limited functionality of the eNaira since launch. Despite the CBN’s stated goal of using the digital currency to boost financial inclusion in Nigeria, spending restrictions remain on those new users who cannot prove their identity with a banking verification number (BVN), effectively excluding millions of unbanked citizens from using it. The eNaira is, additionally, a mobile-first digital currency, living in wallets that can only function in places with reliable access to mobile data. Cross-border payment functionality also remains missing, meaning that the currency remains largely irrelevant to those users daily engaged in receiving remittances from loved ones abroad.

Furthermore, the eNaira faces tremendous headwinds from other, less transparent forms of digital money. Amid a general lack of confidence in the government’s economic policy, cryptocurrency has grown markedly in popularity throughout Nigeria as a hedge against the weak Naira and a straightforward way of transferring money in and out of the country. For consumers dabbling in Ethereum and Bitcoin, therefore, the eNaira is almost irrelevant, explains Professor Joshua Chukwuere of North-West University, South Africa. “You’re not going to get anything from using eNaira,” he says.

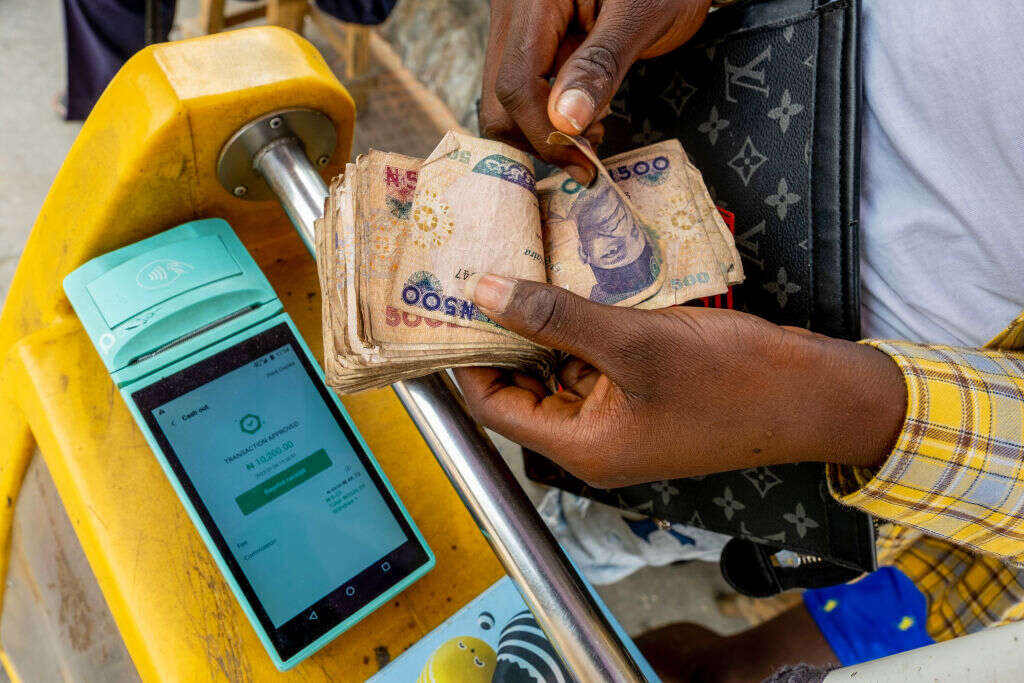

A mobile point of sale operator counts out Nigerian naira banknotes at Idumota market in Lagos, Nigeria. (Photo by Adetona Omokanye/Bloomberg via Getty Images.)

Nigeria’s eNaira: ambition versus reality

The eNaira wasn’t actually built in Nigeria. Instead, its birthplace lies over four and half thousand miles west, inside a nondescript office block in Bridgetown, Barbados. “We’re a company of approximately 70-plus individuals,” says Imran Khan, the executive vice-president for partnerships at Bitt. Describing itself as the ‘world’s leading digital currency experts,’ the company was instrumental in the design and roll-out of one of the world’s first CBDCs, ‘DCash,’ across the Organisation of Eastern Caribbean States.

As such, Bitt was heavily involved in the global conversation among central banks about the CBDCs, a conversation that accelerated during the pandemic. One of the most curious such institutions was the Central Bank of Nigeria (CBN), which faced unprecedented challenges during the first half of 2020 in shoring up the Nigerian economy and disbursing financial relief to the millions of ordinary citizens thrown out of work or unable to run their businesses. This came in addition to systemic weaknesses in the national economy that were only exacerbated by its heavy reliance on cash as a means of exchange.

“Nigeria is a very, very complicated economy,” explains Jack Ree, head of the Nigerian desk at the IMF. While boasting a population of more than 200 million people and healthy exports in petroleum and agricultural products, economic growth had been hampered by a multitude of constraints, including conflict between the government and Islamic extremists in the northeast, systemic corruption, patchy electricity supplies and a general lack of confidence in its currency. It was therefore unsurprising that, as the pandemic hit Nigeria with full force, unemployment shot up to 27% and the government struggled to disburse the cash necessary to meet the welfare needs of many millions of its citizens.

One of the ways the CBN intended on breaking these patterns was through boosting financial inclusion. According to one report in 2020, up to 36% of Nigerians remain unbanked while only a third have access to an ATM or a bank branch within a kilometre of their home. A digital currency, by contrast, would allow the CBN to go over the heads of commercial banks and bring millions of financially excluded citizens into the real economy. It would also help to streamline the process of getting remittances into the country, which according to recent estimates now amount to some $100m per week.

In addition, the eNaira could allow the central bank to know precisely what is going on in the Nigerian economy. “It’s difficult to understand which regions have the highest levels of economic activity when it’s cash,” says Khan. That can have profound implications for tax collection, as well as the effective implementation of monetary policy. Directly controlling the flow and the technical apparatus behind a digitised currency, adds Khan, would grant the Nigerian government many new levers to improve the efficiency of both.

Conversations between the CBN and Bitt on how an eNaira began in June 2021, when the latter was invited to take part in an official procurement process. “The actual shortlist was very short,” recalls Khan, composed of just ten companies with experience in building CBDCs.

The decision to award Bitt the contract, however, would prove controversial. While Khan attributes his company’s victory to its experience in building DCash, an executive from a rival bidder recently claimed to Rest of World that “the selection process was not transparent,” an impression seemingly compounded by the CBN’s interest in acquiring a ‘substantial stake’ in Bitt and making it incorporate in Nigeria (the company denies that these events took place, and that the procurement process was fair and rigorous.)

The 1 October deadline for launching the eNaira was tight, and had to be pushed back until the end of that month. The digital currency that resulted did not immediately meet the CBN’s lofty goals of boosting financial inclusion. There were good reasons for this, says Khan: aside from the short timeframe before launch making it difficult to include anything more than core functionality in the CBDC, prioritising access to banked consumers made it a lot harder for the currency to be used in large-scale money laundering or other illegal transactions.

Nevertheless, he concedes that this market segment already has access to a multiplicity of competing digital payment solutions. “Having only those people maintaining access to the eNaira,” says Khan, “will limit its adoption.”

Critics of the eNaira say that its relevance is currently limited for Nigeria's many small traders. (Photo by Kola Sulaimon / AFP via Getty images)

Expanding the functionality of the eNaira

Adding new functionality to the eNaira could expand its uptake. Khan promises additional features in the coming months, including ways of using eNaira on alternative channels to mobile data, such as USSD. The mobile text message protocol is already widely used inside Nigeria for day-to-day transactions, he adds, and may be the key to dramatically expanding the eNaira’s reach to regions poorly served by mobile and internet networks. Another possible application is an offline debit card, but this is something that Khan says is “not something that we’re working on immediately.”

Khan also talks about more mundane, but no less crucial additions to the eNaira’s functionality: the addition of low-cost merchant fees, for example, and sector-specific tokens that will allow the CBN to stimulate individual industries in financial emergencies. The roll-out of these innovations will, however, remain gradual. “We would like to unlock the capability of innovating, so that those that understand the market most can build additional layers of functionality on top of it,” says Khan.

Ree is also optimistic, considering the eNaira as meeting the criteria for becoming a successful CBDC. While the IMF has pointed out the digital currency’s vulnerability to fraud, the head of its Nigeria desk considers the transaction limits and stringent KYC requirements sufficient protection against this threat. Ree also applauds the CBN’s cautious attitude toward rolling out the eNaira. “Nigeria is bold enough to volunteer itself for this social experiment,” he says – going a lot further than the 87 other central banks that have talked about implementing a CBDC, but have yet to take action.

Nigeria is bold enough to volunteer itself for this social experiment.

Jack Ree, IMF

Even so, ordinary Nigerians still need convincing that the eNaira is worth their time, with figures from earlier this year indicating that peer-to-peer transactions constituted only 10% of the total number made using the digital currency. That’s partly down to a problem with promoting the eNaira, says Khan, which has largely been left to the CBN. “Central banks are not institutions that are used to dealing directly with the general public,” he says. Instead, commercial banks will need to play a greater role in advertising the digital currency to their customers.

That should help in improving uptake of the eNaira among Nigeria’s small trading community, explains Chukwuere, which forms a considerable slice of the country’s economy. “How many people in Lagos today are aware of the eNaira?” he says. Knowledge of the eNaira and what it can do simply “is not there”.

Even if the public profile of the eNaira was to improve, uptake will still be contingent on its relevance to the day-to-day lives of Nigerians. Allowing the eNaira to be used in remittance transactions, explains Ree, would go a long way toward making that happen. “This is where people will feel that, 'Okay, this thing is actually useful,’” he says, in allowing users to recoup the $5 out of the $100 that would otherwise have been eaten up in transaction fees.

It is unclear, however, whether the eNaira will ever challenge the growing popularity of cryptocurrencies. Some crypto advocates have even welcomed it. “I don’t see CBDCs as a threat,” crypto exchange manager Owenize Odia told Quartz, because it meant “more eyes are open to the digital economy.” Ultimately, though, Odia didn’t believe that cryptocurrencies could be stopped, especially given the diminishing barriers to entry. The onboarding process for eNaira, by comparison, remains stringent.

More fundamentally, the eNaira itself doesn’t address public misgivings about the weakness of the national currency. As such, investing in products like Ethereum or Bitcoin still retains considerable appeal, given their (unfounded) reputation for consistent appreciation.

For her part, Salami remains optimistic as to the eNaira’s future, especially if measures are taken quickly to improve its functionality in the coming months. “There is a need for the CBN to think very quickly about mechanisms to improve accessibility to the eNaira, without necessarily watering down its KYC/AML requirements,” she says. That also needs to be matched by a sustained effort at making the digital currency relevant to those who regularly receive remittances.

If these efforts are not made, says Salami, Nigerians may become disillusioned, “and view the eNaira as another project that was poorly implemented and of little practical relevance to the most needy”.