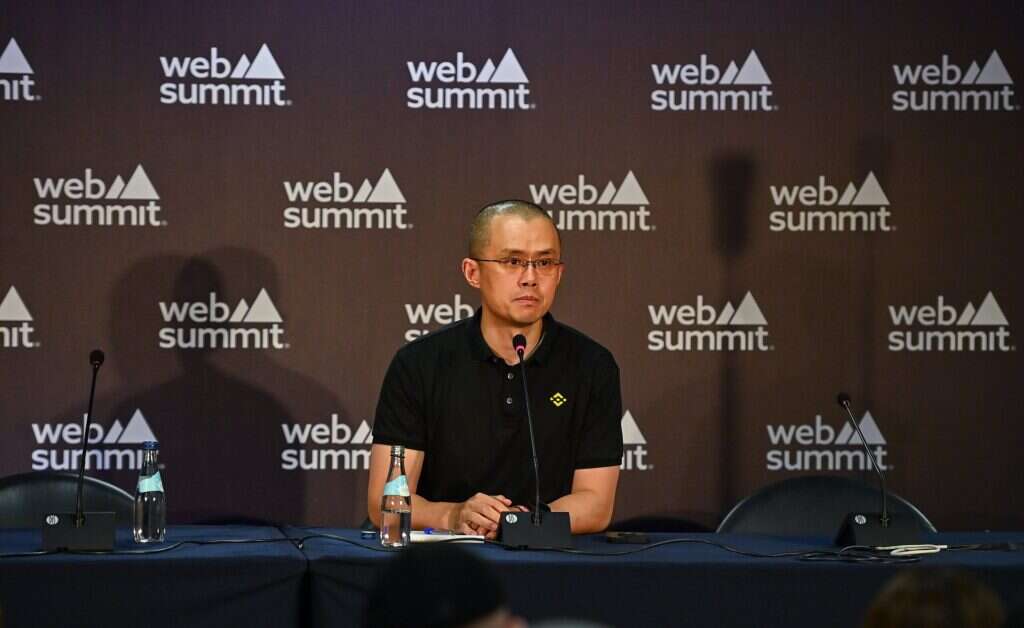

The CEO of Binance, the world’s largest crypto exchange, has pleaded guilty to money laundering charges and resigned. Changpeng ‘CZ’ Zhao, who founded the crypto trading platform in 2017, was also barred from further involvement in Binance’s operations and fined $50m by US prosecutors ahead of a sentencing hearing in February.

Binance itself has also pledged to pay a fine of $1.81bn and an additional $2.51bn to resolve other charges relating to wire fraud, money laundering and sanctions violations. The firm’s global head of regional markets, Richard Teng, has been appointed as its new chief executive to replace CZ.

US Attorney General Merrick Garland said that the sums constituted one of the largest financial penalties ever obtained from a corporate defendant in a criminal case. “From the very beginning, Zhao and other Binance executives had engaged in a deliberate and calculated effort to profit from the US market without implementing the controls that are required by US law,” said Garland, adding that prosecutors had traced high numbers of illegal transactions taking place between US users and those in sanctioned nations like Iran and Syria.

As recently as last month, Israel shut down more than 100 Binance accounts it alleged were raising money for Hamas, according to the FT.

Accountability questions for CZ and Binance

In a separate statement, US Treasury Secretary Janet Yellen said that Binance had failed to flag “well over 100,000 suspicious transactions” to the authorities that were linked to criminal activities like drug trafficking, ransomware attacks and terrorism. As part of its agreement with the US government, Binance will now establish a new internal anti-money laundering programme and its transactions, accounts and systems closely monitored by a third-party monitor nominated by the Treasury Department. “Failure to live up to these obligations,” said Yellen, “could expose Binance to substantial additional penalties.”

Cryptocurrency expert David Gerard believes these extra requirements may put impossible pressure on the crypto exchange in the near future. “This is the death knell for Binance,” Gerard told Tech Monitor. “Two compliance officers will be embedded in Binance with 24/7 access to customer information and transactions and reporting anything suspicious back to the US government. We’ll see just what proportion of Binance’s customers and transactions really were legally questionable.”

CZ’s resignation caps a troubled two years for Binance as it struggled to navigate strong market headwinds and mounting concerns from regulators and banks about the levels of fraud taking place within the cryptocurrency market. The latter was seemingly encapsulated by the collapse of crypto exchange FTX last year, which left Binance as the only large trading platform in the sector. Though many in the industry hoped Binance could be the platform to drive wider adoption of crypto by consumers and businesses, it has been harried by regulators in multiple jurisdictions in recent months, forced out of the Netherlands and Canada, and ended its applications to operate in Germany and the UK.

Further regulatory scrutiny for crypto likely

After resigning, Zhao confirmed on X that he was unlikely to helm another start-up again. However, the entrepreneur added, “I may be open to being a coach/mentor to a small number of upcoming entrepreneurs, privately. If… nothing else, I can at least tell them not to do.”

For her part, Yellen signalled that US regulators would continue to closely scrutinise the crypto sector for evidence of money laundering, fraud and general malfeasance. “[If] the virtual currency exchanges and financial technology firms wish to realize the tremendous benefits of being part of the US financial system they must play by the rules,” she said. “If they do not, the US government will take action.”