The UK saw the world’s steepest decline in trade activity globally in Q2, new analysis of business-to-business transaction data published today reveals.

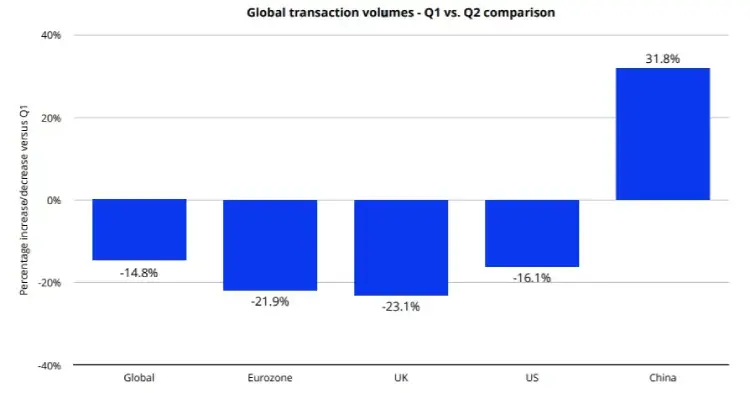

Trade activity plunged 23.1% in Q2 in the UK, a report by Tradeshift — a digital supply chain payments and marketplace specialist — emphasised, versus an average 14.8% decline globally (somewhat skewed by a massive resurgence in China).

The company processes over $500 billion in transactions across its business commerce platform each year, for approximately 1.5 million buyers and suppliers who use Tradeshift to place orders and process invoices, among other functions.

The report, as a result, captures a tidy snapshot of supply chain transactions as a proxy for broader trade activity. As Tradeshift notes: “According to the World Trade Organisation, global trade is expected to fall by between 13% and 32% in 2020…”

“Trade activity in the UK has been hit hardest, and our data aligns closely with official figures from the ONS, which reported a fall of 20.4% in GDP in April.”

Tradeshift Report: Chinese Transaction Volumes Surged 430% in Feb

China, which experienced the most significant impact on trade in Q1, saw trade activity rise by 31.8% in Q2. Transaction volumes in China meanwhile surged by an incredible 430% when factories reopened at the end of February, Tradeshift data shows.

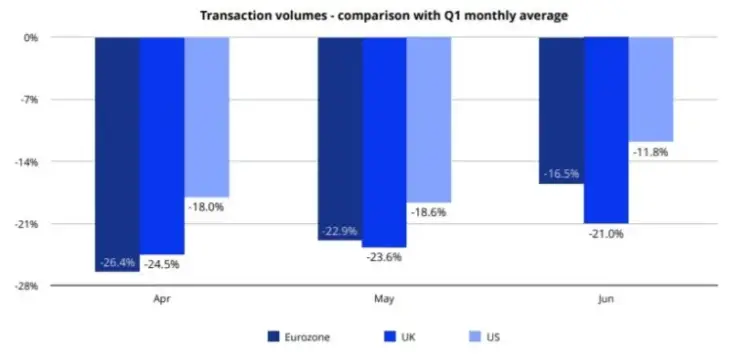

The Eurozone has benefited the most from a ‘post-lockdown bounce’, with orders rising 24% in June compared to April lows. Order volumes in the US and UK have also begun to increase since the end of May, but the surge in activity has been less pronounced.

Payments to Suppliers are Lagging

While order volumes are trending upwards, payments to suppliers are not keeping pace with the recovery, Tradeshift noted: “Invoice volumes across the EU, UK and US fell by 19% as a whole in Q2, and while activity is picking up heading into Q3, it is doing so slowly. With many suppliers running low on cash after a prolonged period of inactivity, lack of working capital flowing through supply chains could well prevent these suppliers from fulfilling orders, putting a brake on recovery.”

“Trying to restart supply chains without fast and predictable access to working capital is a little like trying to start a car without any gas in the tank. It doesn’t get you very far,” added Tradeshift CEO Christian Lanng: “As we enter a new chapter in the pandemic, we need to start looking at fresh ways to unlock liquidity.”

IT Spending Also Set to Contract

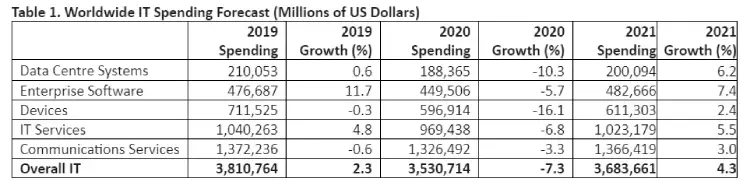

Worldwide IT spending meanwhile is also projected to decline notably in 2020 to a total of $3.5 trillion; a decline of 7.3% from 2019, according to Gartner, Inc. this week.

But there was good news too: “Overall IT spending is still expected to sharply decline in 2020 but will recover in a faster and smoother manner than the economy,” said John-David Lovelock, distinguished research vice president at Gartner. “Still, organisations cannot return to previous processes that are now rendered outdated due to the disruption of their primary revenue stream during the pandemic.”

“From movie theatres to banks, COVID-19 is forcing all organizations to get creative and stay afloat without exclusively offering physical experiences.

“Specifically, CIOs with less immediate cash on hand should plan on becoming more digital than they had originally anticipated at the start of 2020.”

Banner image (Dover) credit: Stefan-Daniel Petcu, Unsplash, Creative Commons

See also: HSBC Signs Sweeping AWS Deal