Reports from analyst firm Kable reveal that the budget allocation for private cloud is much higher than both public and hybrid cloud deployments.

In 2014 the allocation for private cloud wass 39.9%, while public (32.3%) and hybrid (27.8%) lagged behind. The report shows that the prediction for the following year (2015) will see private grow slowly to 40.2%, while public would also see growth to 33.2%.

Meanwhile, hybrid is expected to drop to 26.6% which is surprising given the movements in the market from the likes of Google and Microsoft which have been working together with private cloud vendors to produce a hybrid model.

Companies like Microsoft and Google have embarked on hybrid projects in response to market requests for hybrid solutions.

Looking at the breakdown of services reveal that in 2014 the allocation of budgets was evenly split between Infrastructure-as-a-Service (35%) and Software-as-a-Service (34.8%), while less is allocated to Platform-as-a-Service (30.2%).

According to Kable, this is likely to change significantly for 2015, with IaaS becoming the dominant choice for budget allocation (36.1%) compared to SaaS (33.3%). This could be partly due to the relative expense of the services in question.

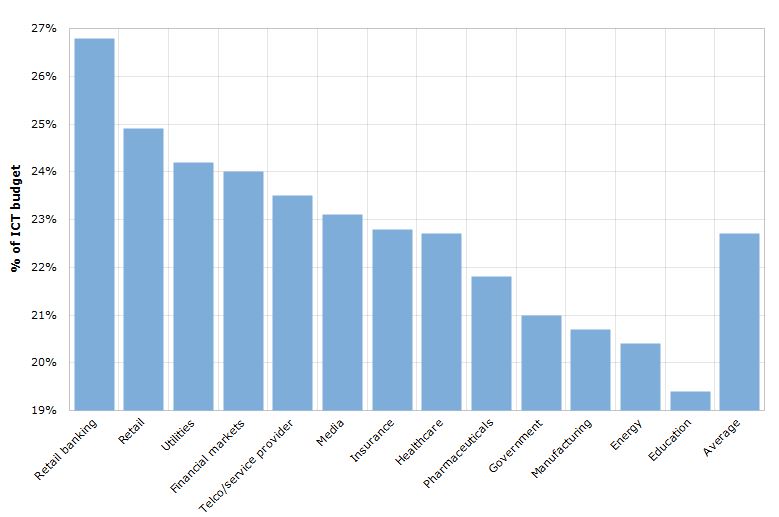

Breaking down the cloud service spending to market sections reveals that retail banking is spending a higher proportion of its external ICT budget on cloud than other industry sectors.

Retail banking spends 26.8% of its budget on cloud, which is expected to rise to 32.4% this year. Retail, as opposed to first placed Retail banking, comes in with the second highest cloud allocation with 24.9%, which is expected to rise to 30.5%.

These growths could be attributed to increased demand for cloud services in these areas, while things like changing regulations and increased demands for added security in cloud services could be identified as contributory factors.

Overall the cloud trends research identifies continued market growth, with the combined market sectors average cloud spend increasing from 22.7% to 28.5%.

All figures come from Kable’s ICT Customer Insight survey, which polled 2685 respondents, from across the world in Q4 2014. The survey findings include data on hardware budget allocation, telecommunications budget allocation and software budget allocation. Subscribe to Kable here.