AMD has unveiled plans to begin mass production of its latest artificial intelligence (AI) chip, the MI325X, in the fourth quarter of 2024. This move is part of the company’s strategy to strengthen its foothold in the Nvidia-dominated AI chip market.

The US semiconductor company’s chief executive, Lisa Su, also announced plans to launch next-generation AI chips. The new MI350 series chips are expected to be released in the second half of the next year. These chips will feature increased memory and a new architecture expected to significantly enhance performance compared to the existing MI300X and MI250X models.

Despite these announcements, AMD’s stock saw a nearly 5% decline, with some analysts attributing the drop to the lack of major new cloud-computing customers for the AI chips. On the other hand, shares of its rival Nvidia rose by 1.5%, while Intel, another chip major, experienced a 1.6% decrease.

The demand for AI processors, driven by major technology firms such as Microsoft and Meta Platforms, has far exceeded supply. Both Nvidia and AMD have benefited from this surge, with AMD’s stock up approximately 30% since early August.

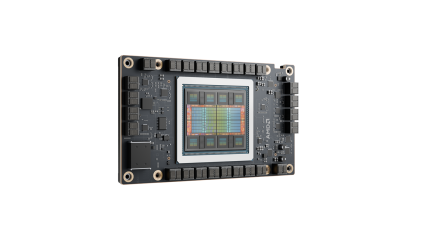

AMD confirmed that vendors, including Super Micro Computer, would begin shipping the MI325X AI chip to customers in Q1 2025. The MI325X uses the same architecture as the MI300X chip, which was launched last year, but features new memory designed to enhance AI processing speeds.

In addition, the company introduced several networking chips aimed at improving data transfer between chips and systems in data centres. The company also launched a new version of its server central processing unit (CPU) design. Formerly codenamed Turin, the family of chips encompasses a version designed to optimise data flow to graphics processing units (GPUs) for faster AI processing.

AMD also launched three new PC chips for laptops, based on the Zen 5 architecture, which are optimised for AI applications and will support Microsoft’s Copilot+ software.

AMD’s AI strategy

In August, AMD agreed to acquire ZT Systems in a cash and stock deal worth $4.9bn. The latter is an AI and general-purpose compute infrastructure provider for hyperscale computing companies, engaged in the supply of hyperscale server solutions for cloud computing. The firm boasts a global manufacturing operation spanning across the US, the EMEA and APAC regions.

AMD’s new plans have come amidst the semiconductor industry facing intense demand, driven by the growth of AI applications. The rise of generative AI and advanced technologies has strained supply chains as companies increase production of AI-focused chips. This spike in AI chip demand has raised concerns about potential shortages.

According to a report by Bain and Company, the AI-driven surge in demand for GPUs alone could increase total demand for certain upstream components by 30% or more by 2026. Despite investments like the US CHIPS Act, supply constraints and geopolitical tensions may hinder the industry’s ability to meet demand, particularly given the complexity of scaling production for advanced AI chips.