SK Hynix has said that its range of high-bandwidth memory (HBM) chips has sold out for this year, with none available to customers until 2025. A crucial component inside AI chipsets, the news comes amid high demand among enterprise users for increasingly complex AI applications. SK Hynix added that even those HBM chips available for customers next year would soon run out.

“The HBM market is expected to continue to grow as data and model sizes increase,” said SK Hynix’s chief executive Kwak Noh-Jung. “Annual demand growth is expected to be about 60% in the mid-to-long-term.”

SK Hynix profiting from increasing demand for AI chips

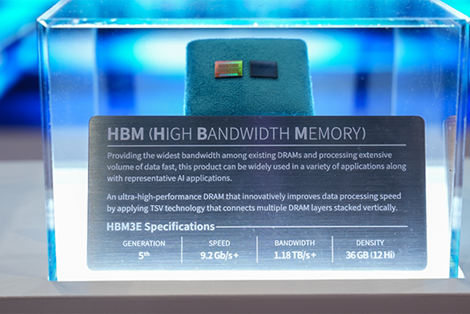

So-called “AI chips” deliver the computational heft necessary to efficiently train new AI models, over and above conventional central processing units (CPUs). Nvidia’s B200 GPU, for example, harnesses 208bn transistors to deliver up to 20 petaflops of FP4 processing power (a typical CPU, by comparison, only boasts 10bn transistors.) HBM chips are a vital component within AI chipsets, providing them with the rapid data exchange necessary to undertake computationally-intensive tasks necessary for model training.

SK Hynix is one of the world’s most important suppliers of HBM chips and one of Nvidia’s main suppliers. Last month it reported its second-highest operating profit ever after five consecutive quarters of net losses, as semiconductor manufacturers rushed to incorporate its HBM chips into product portfolios increasingly geared toward facilitating AI applications. SK Hynix also revealed an ambitious expansion strategy, including the expansion of an existing fab in South Korea, the commencement of HBM chip manufacturing at a facility in the US state of Indiana, and new plans to collaborate with TSMC on the next generation of HBM chips.

Samsung, Micron and Huawei keen to harness HBM chips

SK Hynix’s competitors have also been hard at work in expanding their HBM chip production. This includes Samsung, which recently adopted a manufacturing technique first pioneered by SK Hynix, and Micron, which began mass production of its High Bandwidth Memory 3E chips in February. China’s semiconductor firms are also increasingly interested in harnessing HBM chips. Last month, The Information reported that a group of Chinese chipmakers including Huawei recently lobbied Beijing to support the creation of a domestic HBM chip manufacturing base.