Nearly a year since the start of the pandemic, Robert Stoneman, Principal Analyst for Local Government at GlobalData, looks at recent research on the underlying pressures facing councils and the key take-aways for suppliers.

COVID-19 has exposed the challenges and inequalities across our society and laid bare the precarious position many councils find themselves in. With the recent financial collapse of Croydon Council in mind, there are fears other local authorities may also follow unless a long-term financial settlement is reached. There are also concerns this could jeopardise further efforts at digital transformation despite the pivotal role technology has played in the response to the pandemic.

If local government technology suppliers are to continue supporting the sector as it emerges from the pandemic, they must have a clear picture of the pressures facing each council. In light of this, GlobalData has recently undertaken some research examining the underlying pressures facing each local authority.

This blog summarises the key findings and explains what it will mean for the local government technology market in the year ahead.

Capturing Council Complexity

Each local authority faces a unique range of financial and demand-related pressures. Therefore, more traditional attempts to break the market down by geography or council type often gloss over these important differences. For instance, while officially a single group, metropolitan borough councils include a mix of major urban centres, industrial cities, and prosperous smaller towns, each facing different sets of pressures and challenges.

This is why GlobalData has produced an alternative approach to breaking down the local government sector, focussing instead on the two key issues facing all councils: financial pressures and changing service demand. For the former, a range of metrics is used to get an overall picture of each council’s finances, including reserves, diversity of income, change in income, commercial income, capital expenditure and debt.

For the latter, GlobalData evaluated what each local authority currently spends on services and determines future demand based on population, traffic, and waste projections. This assumes business-as-usual in the coming years and does not consider any major policy changes at a local or Whitehall level.

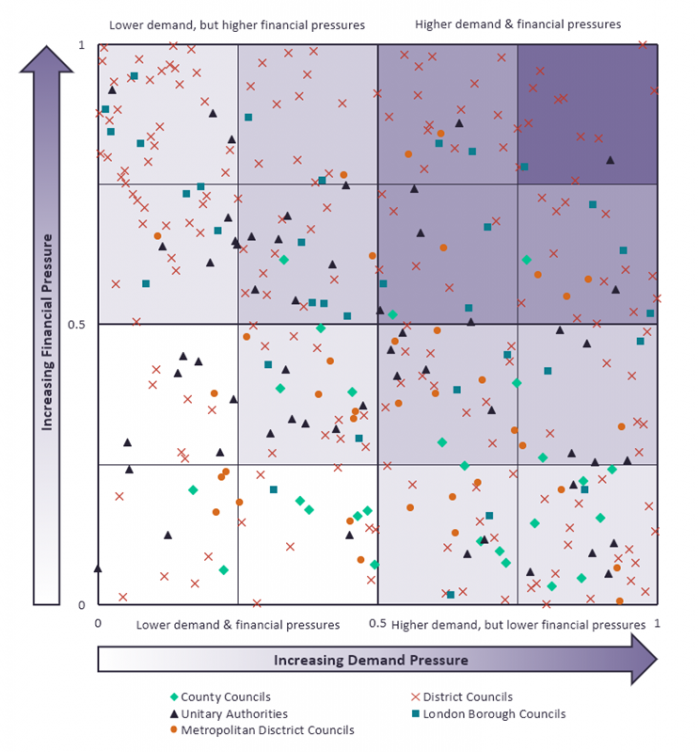

GlobalData Segmentation of the UK Local Government Market, February 2021

When each council in England is ranked against each other according to these measures, a more nuanced picture of the pressures affecting the sector emerges. As shown in the chart above, which maps each council’s position relative to one another, those positioned closer to the top right face the most intense financial and demand-related pressures. By comparison, those close to the top left are facing higher financial pressures, but lower demand related ones, and those closer to the bottom right greater demand-related pressures, but lower financial ones.

Three Key Takeaways

Since clusters of councils near each other represent those facing similar underlying challenges and pressures, there are three initial takeaways we can pull out.

Firstly, relative to other local authorities, county councils appear more financially resilient compared to others despite each authority facing a wide range of future demand on services. The clustering of county councils is not surprising considering they are less reliant on income from sales, fees or charges (SFCs), all sources which are potentially at risk due to the pandemic. Instead, they are more reliant on council tax receipts, something that local authorities at least have some control over (via an up to 5% permitted increase for 2021-22).

Secondly, by contrast, there is a lot more variation across lower-tier district councils. Not only are district councils more reliant on SFCs, but they also depend more heavily on business rates that are at risk during an economic downturn. This matters because the Government only offers a safety net to councils that is well below the current level of rates they collect (assessed at 92.5% of the real-terms amount when assessed way back in 2013–14). While 100% relief is currently in place for business rates in certain sectors – retail, hospitality and leisure, for example – and set to be extended at the upcoming budget, it will not last forever. Unless these industries recover fully, some councils could face a future drop in revenues.

Thirdly, the research also shows just how much variation there is between councils of the same type and geography. This is best illustrated by looking at a single example, Peterborough Council in this case, which faces some of the greatest pressures across the sector. In fact, it is one of four councils (alongside Eastbourne, Bexley and Luton) to receive special emergency funding in recent weeks to balance its books.

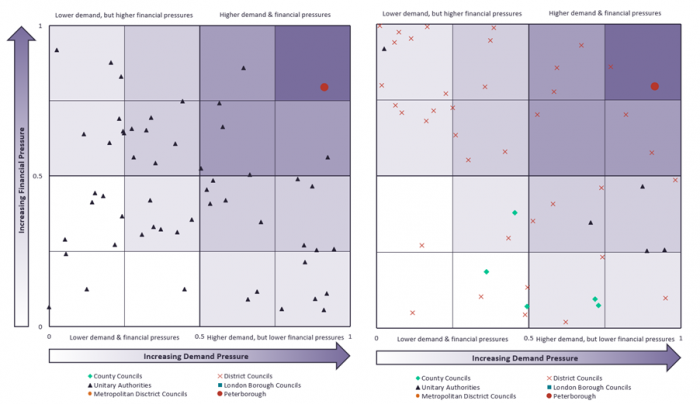

GlobalData Segmentation of the UK Local Government Market, February 2021: Peterborough City Council

By Authority Type: English Unitaries By Region: East of England

When compared to its peers, the difference compared to other unitary authorities and councils within the East of England becomes clear. Peterborough is facing both extreme financial and demand-related pressures at the same time, and some of the greatest within the East of England. This has forced the Council to cut spending last year to avoid opening a £40m black-hole in its finances.

What does this mean for suppliers?

For technology suppliers, breaking down a council’s financial and demand-related pressures can be read as a proxy for their willingness to innovate and spend. That is not to say there are not a range of other key factors that go into spending plans – political, senior leadership and contractual arrangements are all crucial. However, all of these will in some way reflect the underlying pressure facing a particular council, so having a clear picture of this is vital.

Staying with Peterborough to illustrate this further, the Council is attempting to achieve savings and improve services by adopting a shared IT and Digital strategy with neighbouring Cambridgeshire County Council. First agreed in principle in July 2019, the agreement aims to converge services across both councils and adopt a cloud-first approach. This was also prompted by Peterborough’s exit from a decade-long managed ICT contract with Serco in September 2020, a process that involved moving 66 contracts across 41 suppliers back in-house regardless of their long-term suitability.

The severe pressures facing Peterborough help explain why they have undertaken such an ambitious transformation strategy. The decision was no doubt also helped by the fact that Cambridgeshire is under less severe financial and demand-related pressures – according to our research they rank midway among English councils on both financial and demand-related pressures – and so are more able to support their neighbour. However, for Cambridgeshire, the move was likely also prompted by the collapse of the partly council-owned LGSS shared service in December 2020, which previously provided its ICT.

So, put simply, councils under the most financial and demand-related pressures are under the greatest impetus to radically transform their services. However, they may have less willingness or capacity to take risks unless they have some form of support, whether from a neighbour (in the case of Peterborough) or the wider GovTech community.

By contrast, those under less pressure may be more open to more radical and long-term transformation as they have the breathing room to innovate. However, there may not be the compulsion to change if things appear to be working in the short-term.

Either way, suppliers will need to have a rounded view of the underlying pressures facing each council if they are to properly understand the full context of their digital transformation plans.

To find out more about this research, contact the GlobalData Public Sector team.