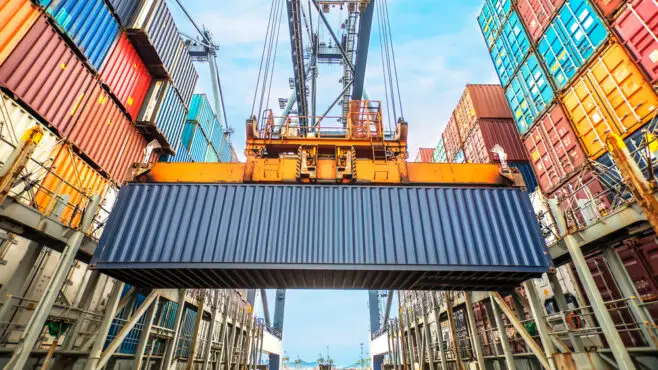

The advent of globalisation can be traced back to containerisation in the 1950s and ’60s, when the standardisation of shipping containers enabled the efficient trade of goods across borders. Digitisation has the potential to accelerate global trade, boosting economic growth around the world, but another watershed moment is needed to overcome the complexity of technology regulation.

Currently, technology regulation diverges across regions and countries, creating a headache for companies that trade internationally. Perhaps most onerous among these are data localisation rules, which require that foreign companies store their data within regional borders, upping costs and limiting the free flow of data across borders.

In the six years to 2017, the number of data localisation requirements doubled, according to the US International Trade Commission. The prevalence of these restrictions is the result of using a global rule book for trade that dates from the 1990s, says Tim Figures, associate director and senior expert on geopolitics and trade impact at Boston Consulting Group.

“We haven’t yet got a global agreement on how digital trade should work, which means that any company operating globally has to deal with a variety of different jurisdictions and processes, some of which are more technologically savvy than others,” he says. “There are different levels of adoption, different standards, different willingness to accept it, and we need to get to the equivalent of the 20ft unit [for digital] to really reap the benefits.”

The complexity of these digital rules is not just an inconvenience: it hinders the use of digital technology to optimise and accelerate global trade. A recent survey by the World Economy Forum (WEF) found that differing tech-related regulation across jurisdictions is the most common hindrance to adoption of trade technology. This, in turn, limits trade itself: “trade tech” adoption would reduce costs and increase efficiency, respondents to the World Economic Forum (WEF) survey believe.

A more harmonised global system of regulation would not only accelerate the shift from analogue paper-based processes to digital tools such as e-documents and signatures, which promise to boost the efficiency of ports and customs borders. It would also simplify international trade in digital services too which, despite the boundary-spanning nature of the internet, is also hindered by regulatory hurdles, such as limits on accessing UK streaming services in the EU.

Global cooperation on digital trade

While there has been some collective action to knock down these trade barriers bilaterally, says Figures, a global approach is needed to provide the 21st century with its containerisation moment.

“If you’re looking to take a major international logistics player like a shipping line, for trade tech to work for them globally, you need to have systems that are accepted by all of the jurisdictions in which they operate,” he says. “Because it’s an international system that requires engagement with so many different players at different levels of technological adoption, it tends to revert to a lowest common denominator.”

Rewriting the global rules for digital trade is “very much on the agenda” for the new director general of the World Trade Organisation (WTO), he adds. Already, action to ban tariffs on e-commerce demonstrates that the WTO is acting to carve out a new role for itself as the architect of a more harmonised global digital ecosystem.

The Covid-19 pandemic has accelerated global co-operation around digital trade and the adoption of trade tech, says Ziyang Fan, head of digital trade at the WEF. “Technologies have always existed in the past and global trade [organisations] have begun to adapt to new technologies, but Covid-19 definitely accelerated it, so that it went from nice to have to must have,” he says, adding that it has precipitated a “mentality shift” at management level about the adoption of trade tech.

Indeed, trade tech provider Essdocs told the Economist that chambers of commerce had adopted its paperless certificate of origin system at six times the normal rate in the early months of the pandemic. And the WEF study found that the pinch from Covid-19 had forced more than half of surveyed companies to reconfigure their value supply chain using tech and increase the visibility of data.

However, attempts to achieve multilateral agreement on digital trade are hampered by growing techno-nationalism, says Jimena Sotelo, project lead of digital trade at the WEF’s Centre for the Fourth Industrial Revolution.

“Big countries can have the privilege [of cutting off trade ties], as they still have the market to roll out these solutions domestically,” she says, but adds that economies need to consider the implications for future tech deployment. “Techno-nationalism doesn’t end with the technology itself, but will have more implications when it comes to trade competitiveness down the road.”

The layers of trade tech

Without an update to global trade rules, companies still view the costs of adopting trade tech and investing in the necessary digital skills as prohibitive, restricting the transformative potential of trade tech, says the WEF’s Fan.

“There are layers when it comes to digitisation; it does not just go from zero to 100,” he says. “The first layer is really from analogue to digital trade and that is the basis of the second layer – only based on data and access of the first layer can you use technologies for optimisation and synchronisation.”

We are still in the first transitional phase and so the focus is on adopting a layer of “fundamental” technologies such as electronic documentation, platforms and payments that will digitalise trade and support a host of more complex trade tech solutions further down the line.

To tap into those benefits, a harmonised global digital ecosystem is paramount, says Fan. “The adoption of new technologies is on the rise, from IoT to AI, robotics to blockchain,” he says. “[But] trade is still one of the few industries that remains to be disrupted. So, we need to foster a better digital trade environment and overall ecosystem for trade tech with more forward-looking digital trade agreements [and] greater interoperability.”