In the UK there is considered to be the ‘Big Five’ banks that dominate the market; HSBC, Barclays, Lloyds, Royal Bank of Scotland, and Santander.

These banks have held a dominant position in the current account market for decades. According to Statistica the ‘Big Five’ held 84% of current accounts in the UK in 2014.

However, the period after the financial crash in 2008 has brought about an influx of challenger banks that aim to do banking in a different way.

Relying upon a customer first approach that is supported by the latest technologies, these challenger banks have sought to offer banking services in a modern way, to people that are always on the go and want greater ease of use and insight into their bank accounts.

CBR highlights five of the leading challenger banks that are revolutionising the banking industry.

-

Metro Bank

The first new high street bank to launch in the UK in over 150 years, Metro Bank is taking a new approach with a familiar flavour. Most of the challenger banks have opted

not to have brick and mortar faces but Metro has decided not to dispense with it.

The bank is open seven days a week and plans to have 200 UK branches open by 2020, it opened its 40th in Maidstone Kent in December 2015.

It offers personal and business services and quotes a time of 15 minutes to open an account at one of its branches.

Now six years old it has amassed over 650,000 customer accounts. While that may only be scratching the surface of the “Big Five” it is certainly making progress.

-

Atom Bank

One of the few challenger banks to be based outside of London, Atom is from Durham, it became the UK’s first digital-only bank.

It doesn’t have branches or call centres, it is an app.

Launched in April 2016 its first products include a one-year fixed saver offering an interest rate of 2.2% and a two year savings product with a rate of 2.2%.

Really the interest lies with the technology it is using. The app is built on a gaming platform called Unity and it aims to offer voice and face biometrics for login, and they also plan to use machine learning and artificial intelligence to improve its services.

This is a truly technology driven approach to banking which aims to, “offer a genuine alternative to the insidious and self-interested banks that dominate the UK banking landscape,” said Atom CEO Mark Mullen when the launch was announced.

-

Tandem

Despite already gaining a banking license and regulatory approval from the Financial Conduct Authority and Prudential Regulation Authority, Tandem is yet to launch.

Basically it is in the ‘mobilisation’ phase for what will be another digital bank, but it is expected to launch before the end of this year.

Big things are expected of the challenger because it is working on concepts like being able to track money like a person tracks their fitness, or tackling holiday charges.

The challenger aims to offer a daily spend roundup, in both pounds and foreign currency, upfront and up-to-date exchange rates, and no fees when cash is taken out anywhere in the world.

A lot is expected from Tandem and plenty of people will be on the look-out for it to achieve some of its lofty goals with technology.

-

Starling Bank

Granted its UK banking license in July this year, the challenger aims to launch in January 2017.

The bank has been focused on building its product and technology from the ground up and it plans to tap into the rising number of mobile banking users, expected to be 32.6m by 2020.

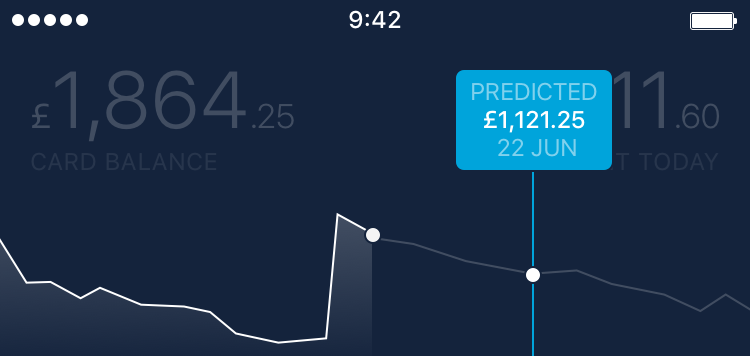

When it launches it plans to offer data-led insights to give customers a clear picture of their finances, insights into spending habits, and real-time notifications.

Unlike the Unity based Atom Bank app, Starling is building a full-stack bank from scratch, this means that its systems are purpose-built to focus on a single account that can be accessed on a mobile.

Like Tandem, Starling is offering a lot but there is no end product on display so it’s uncertain whether it will appeal to customers.

-

Monzo Bank

Formerly called Mondo, it had to change its name following a trademark dispute, this is another app only bank.

The bank started out in February 2015 with a prepaid debit card ahead of it being awarded regulatory approval in blah, it plans to offer checking accounts from next year after restrictions are lifted.

The bank is currently live with limited edition Alpha and Beta cards which can be topped up through the mobile app and used at cash machines, in-store, online, and at contactless terminals.

Monzo already has 30,000 prepaid card users and a lengthy waiting list and compared to some of the other challengers it feels a lot closer to being a real bank.

The app breaks down spending across a number of different categories such as transport, groceries, shopping, eating out, cash, bill, entertainment, holidays and more.

The app has now also integrated with Siri to make it even easier for people to use.