The independent telecoms, internet and digital media analysts at IDATE DigiWorld have announced a number of trends to look out for over the next decade in its annual DigiWorld Yearbook report, out this month.

These include cheaper smartphones, dwindling sales of tablets, the increasing use of IoT technologies, Artificial Intelligence (AI) and Virtual Reality (VR), and sustained growth in the digital economy. The European think-tank expects to see a continued rise in cyber-attacks and trust issues surrounding digital companies, which will lead to enhanced security protocols as consumers embrace the Internet of Things (IoT), especially to help protect their connected cars or smart homes. Improved connection speeds, especially for Europe, and better reliability for mobile and household internet services are also on the cards, with a gradual move from 4G to 5G and fibre-optic broadband (FTTH).

In its research, IDATE DigiWorld looks at how further consolidation in the telecoms industry could be replaced in future by more cross-industry mergers between networks, technology, television, media, transportation and industry: for instance, companies like Google and Apple making further in-roads into the automotive industry; or major telco and tech companies buying more into television and streaming services.

With sustained growth in online services, the industry experts at IDATE DigiWorld expect a gradual shift away from owning to using: for example, people sharing cars via an app; or streaming music and video-on-demand films, rather than buying CD’s, DVD’s or downloads. The move towards more on-demand, subscription services is likely to be driven by the increasing use of ad-blocking software which, in turn, could make the abundance of free internet services (like YouTube) a thing of the past.

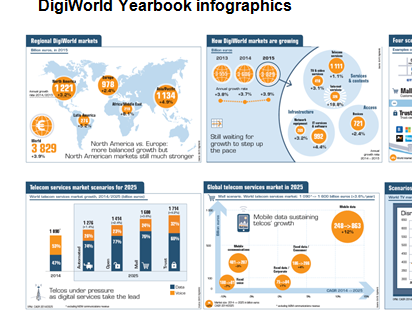

"A wide range of services are sold for a minimal per-unit cost and consumed en masse, which helps to build a gigantic digital services market for telecoms and internet, estimated at more than €2,900 billion in 2025, or almost 7% annual growth," said the report.

The two-hundred-page report also considers how Bitcoins, blockchains, mobile payments and crowdfunding will impact the future of banking and finance, arguing that further development in internet services will help ‘cut out the middleman’ in other industries too, like travel and retail. Other considerations include Big Data and how EU legislation is coping with data privacy and protection, as well as how, in future, more access to personal data might affect people’s insurance premiums or requests for loans.

"We’re riding a wave of innovation that’s never been seen before, especially in the business sector with the continuing migration to the Cloud and the prospects that the Internet of Things, Big Data and Artificial Intelligence might bring. However, at the same time, this throws up a number of potential issues, such as how the Public Cloud is now in the hands of tech giants like Amazon, Google and Microsoft," said François Barrault, President of IDATE DigiWorld.

Despite a context of relative saturation, as shown by recent stagnation in smartphone sales, IDATE DigiWorld predicts modest growth returns for Western telcos and digital media companies during the years ahead; but bigger gains in China, India and Africa, where further global consolidation is expected both at the European and worldwide level. In television, Asia/Paci?c will become the world’s largest market during the next decade, while growth in the main European markets will be weak, and possibly even negative.

"European markets are also still very much weighed down by a very tough competitive and regulatory climate for telecom carriers whose revenue has been on a downward slide since the late 2000s," said Yves Gassot, CEO of IDATE DigiWorld. "Internet services continue to enjoy double-digit yearly growth of nearly 15%. The segment is expected to represent close to 10% of the entire digi-world in 2016, a ?gure that will only increase in the near future: in just two years from now, internet services will be out-earning television and video services, which will nevertheless continue to grow by 3% to 4% a year."

The DigiWorld Yearbook 2016 has been compiled using its own datasets, market reports and 2025 prospective analysis with the support of many leading players in telecoms, IT, internet, TV and digital media, with more than 50 members that include Accenture, AT&T, BT, Google, Gemalto, Huawei, IBM, Microsoft, Orange, Tata and Samsung.